The focus, according to the secretary, will be on Desenrola, a debt renegotiation program for private individuals

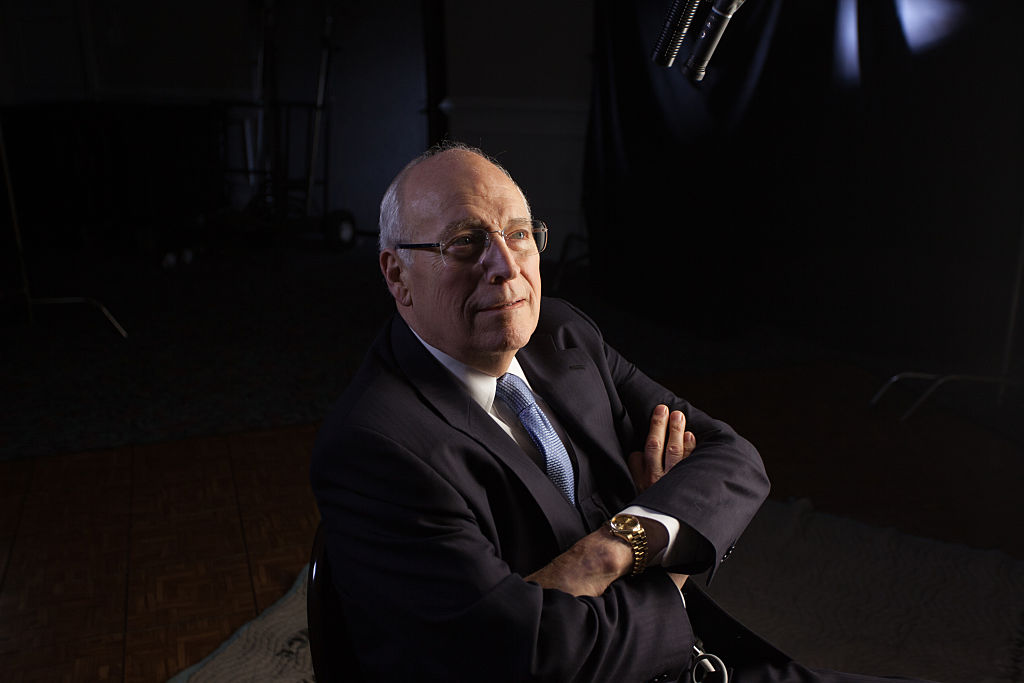

number 2 of Ministry of Financeor executive secretary Gabriel Galípolo he says the economic team will take action to try to avert a credit crisis in the country and to boost the economy to ensure growth. The possibility of a sharp slowdown in the credit market in a high interest rate environment has entered the radar and threatens the growth of the Brazilian economy in 2023.

The crisis of American shops and reports from banks to curb the supply of credit have reinforced the concern of businessmen and financial market operators.

To the Stadium the secretary indicated that the government could resort to compensatory measures to guarantee liquidity to companies if necessary. “The government and the economic team are fully focused on avoiding a credit crisis in the country,” he said. According to him, the ministry monitored the situation daily with the commercial and financial sector to anticipate. Galípolo added that the partial federal revenue collection data for February is very positive, showing a recovery in pension fund revenues with a positive reaction from the activity.

The focus now will be on Desenrola’s private debt rescheduling program. Galípolo anticipates that the measure will also serve debtors with incomes above two minimum wages. Today the country has 70 million negatives, which he assessed as “a very serious situation” and which “requires rapid action”.

Announcements in recent days of readjustment of the minimum wage, correction of Income tax and the new My home my life they are part of this strategy to counter worsening credit and avoid an economic recession

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.