The ceiling should be between 1.8% and 2% per month; banks suspended lending arrangements after government lowered cap to 1.7%

BRASILIA – The government of the president Luiz Inácio Lula da Silva Monday 27th at 7pm there is a meeting at the Civil House to decide the limit that banks can apply to the interest rate on the salary loan of the National Social Security Institute (INSS) – methods for discounting the amount directly to the benefit of pensioners and retirees.

As shown the Stadiumthe roof must rise and stay between 1.8% and 2% per month. This is because of the decision of the National Social Security Council (CNPS) to lower the ceiling from 2.14% to 1.70% per month took the banks to temporarily suspend lending of the mode – including public banks, such as Banco do Brasil and Caixa Econômica Federal, and private banks, such as Itaú Unibanco.

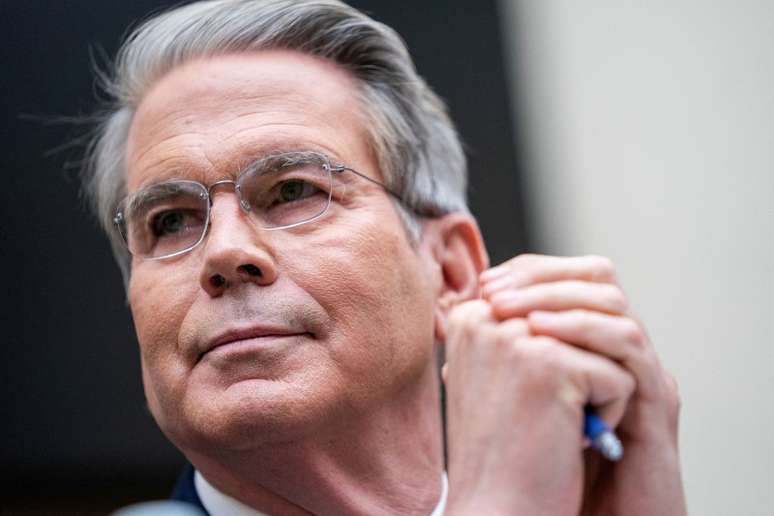

The CNPS, chaired by the Minister of Social Security, Carlo Lupi (PDT), defines the limit of interest that can be charged on this credit line, but the commission is borne by each financial institution. The president of the Caixa, Rita Serrano, has set as a basic condition for the continuation of the discussions that the council bring the rate back to the minimum level of 1.81% per month. According to financial institutions, the 1.7% level makes the deal unviable as it leaves the institutions’ profit margin negative.

Faced with the possibility of a rate hike, the INSS beneficiaries may end up being forced to look for more expensive lines – 42% of borrowers in this mode are negative, which makes it difficult to get into debt. The pay slip has the lowest market rate because the share is already deducted from the pay slip or from the benefit, in the case of the INSS.

After the reaction of the banks, the Minister of the Civil House, Rui Costa, Carlos Lupi (Welfare) and the executive secretary of the Ministry of Finance, Gabriel Galípolo, met and agreed on the need for the government to adopt a “middle ground”. ” , which would fluctuate between 1.8% and 2% interest, but there was no agreement on the level.

Last Tuesday, 21, President Lula classified the CNPS initiative to lower the interest rate ceiling for the modality as “good”, but he criticized the attitude of Minister Carlos Lupito implement the provision without first negotiating it with private banks and having the tender agreed with the Civil House.

“Something that could be good, 100% favorable, created a climate of dissatisfaction in the banks that had to be prepared. You can’t download as easily as they want you to download. In any case, the thesis is good and now we will see how we can really bring interest rates down,” Lula said.

Tuesday the The president of the Brazilian Federation of Banks (Febraban), Isaac Sidney, met with finance ministry technicians to discuss the matter. “There is a dead end and we have to get out of this dead end,” she said. Febraban and the banking sector are fully prepared for us to find a level that can, on the one hand, satisfy the government’s desire and, on the other hand, enable the economic viability of the payroll loan operation.”

The reduction in tariffs had been defended by Minister Lupi. Took office on January 3, criticized the level of interest in retireeswhich he called high, addressing the president of the Brazilian Federation of Banks (Febraban), Isaac Sidney, and the president of the Bank of Brasilia (BRB), Paulo Henrique Costa, who were present at the ceremony.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.

![A More Beautiful Life in Advance: Jennifer Gets Lost in the Feelings… What’s in store for the week of October 27 – October 31, 2025 [SPOILERS] A More Beautiful Life in Advance: Jennifer Gets Lost in the Feelings… What’s in store for the week of October 27 – October 31, 2025 [SPOILERS]](https://fr.web.img6.acsta.net/img/da/bf/dabf67a32e462c255362445e30b8ae1c.jpg)