According to a survey by Protests, 41% of respondents have stopped paying by credit card

A protestConsumers Association, published last April the results of the third edition of the behavioral survey on “Aspects of debt”. The study was conducted in the cities of São Paulo and Rio de Janeiro, with 500 respondents.

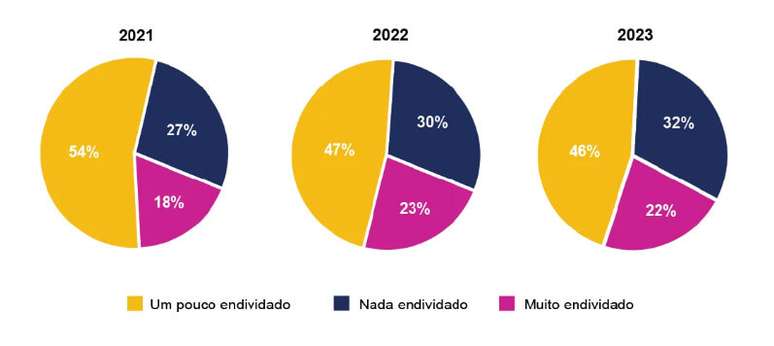

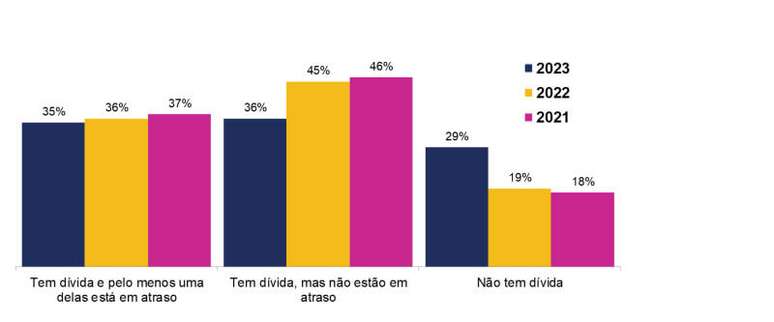

The research aims to understand the degree of consumer indebtedness and what behaviors and external factors cause the consumer to become indebted.

Brazilian debt is worrying and has reached the highest historical level ever recorded: according to data from the National Confederation of Commerce of Goods, Services and Tourism (CNC), 77.9% of the population is in debt. And according to the latest Serasa survey, 69.43 million people entered 2023 with limited name.

List of 10 unpaid bills

According to the survey results, 41% of respondents stopped paying at least one bill in the last year. Of these, 41% stopped paying the credit card, with an increase of 29% compared to the previous year, 32% the internet bill and 30% the energy bill.

- Credit card ― 41%

- Internet — 32%

- Light – 30%

- Loan – 25%

- Telephone/Mobile – 23%

- Water – 19%

- IPTU – 18%

- Rent – 13%

- Gasoline – 6%

- Financing – 4%

As in previous editions, the most indebted consumers are those with the lowest incomes (between 1 and 2 minimum wages). Furthermore, in 2022, 24% of respondents said they were consuming less. This year, that figure has jumped to 35%.

The bad guys of debt

The bad use of credit cards continues to be considered the main cause of debt: 74% of those interviewed indicated the method of payment as the reason for debt. In second place stands unemployment, considered a factor of debt by 37% of respondents. This item has advances, since in 2022 it corresponded to 44% and in 2021 to 65%.

And when it comes to choosing what not to pay, the credit card is once again a highlight: practically half of those interviewed said they had already stopped paying at least one bill in the last year and of these, 41% have stopped paying. to pay credit card – a 29% increase over last year. Alongside credit card bills, 32% have stopped paying their internet bills and 30% have stopped paying their energy bills.

HOMEWORK inspires transformation in the world of work, in business, in society. It is creation ofCOMPASS

content and connection agency.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.

![TOMORROW BELONGS TO US IN ADVANCE: THE PHILIPPINES WILL DO EVERYTHING TO PROTECT CHARLES… WHAT’S AHEAD OCTOBER 27 TO OCTOBER 31, 2025 [SPOILERS] TOMORROW BELONGS TO US IN ADVANCE: THE PHILIPPINES WILL DO EVERYTHING TO PROTECT CHARLES… WHAT’S AHEAD OCTOBER 27 TO OCTOBER 31, 2025 [SPOILERS]](https://fr.web.img6.acsta.net/img/b2/7f/b27f5a3fbc55d29b821eff36e2cd8a48.jpg)

-soq6i9m0ttgh.jpg)