The Bank of Japan said on Wednesday it will reduce the amount of bonds purchased in its regular operations in the January-March quarter, as the central bank seeks to provide more liquidity to the market.

The Japanese central bank has cut minimum purchase volumes for bonds with maturities between one and 10 years and reduced the frequency of purchases of longer-dated bonds.

The Bank of Japan has been aggressively buying bonds to defend its ultra-low rate policy, which has squeezed liquidity into Japanese government bonds and distorted the yield curve.

The curve has corrected as the central bank loosened its grip on the benchmark 10-year bond yield cap, but the bank remains a dominant owner of government bonds.

The market had expected this reduction as the Bank of Japan has gradually cut the amount purchased in recent deals as yields fell to multi-month lows reflecting declines in Treasury bond yields.

Source: Terra

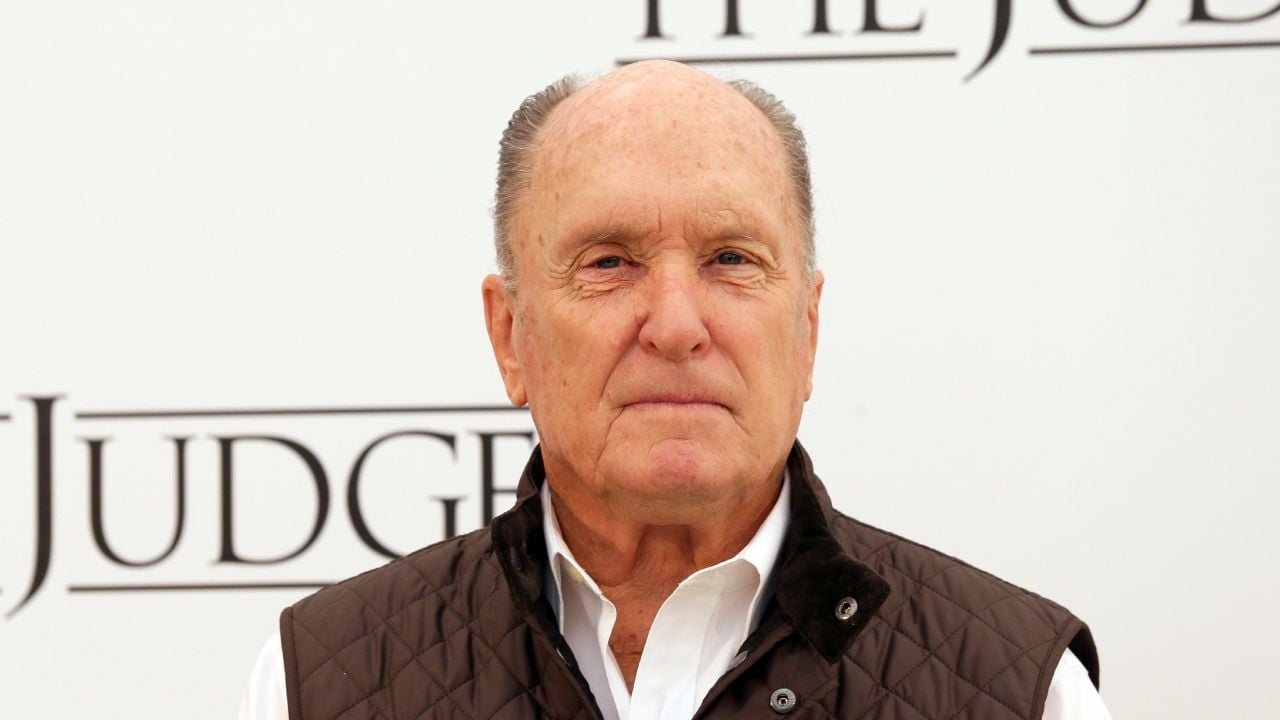

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.