Iron ore futures fell for a third straight session on Wednesday, hitting their lowest level in nearly four months, as concerns persisted about short-term demand in China, the ore’s main consuming market.

The most traded iron ore in May on the Dalian Commodity Exchange closed daily trading 3.98% lower at 893 yuan ($124.29) per ton, the lowest close since Oct. 31, after a decline of more than 5% compared to the previous day.

Benchmark March iron ore on the Singapore Exchange fell 1.8% to $118.65 a tonne, also hitting its lowest since Oct. 31.

Among the factors putting pressure on prices of the key steel-making ingredient are rising supply at a time when the recovery in demand has been slower than expected following the week-long Lunar New Year holiday , analysts said.

“Supply from the main producers, Brazil and Australia, has so far remained at a relatively high level compared to previous years; the weather this year in the main production centers is better than the average of the last five years,” Pei said. Hao, an analyst at Shanghai-based international brokerage FIS.

“Weak profitability at many steel mills has limited growth in ore demand in the near term.”

Inventories of the five major finished steel products held by traders in 132 cities across the country rose to nearly 11-month highs in the week ended Feb. 17, jumping 15.6% on the week, according to Mysteel’s latest survey. previous.

Other steel ingredients in Dalian rose on supply concerns, with metallurgical coal and coke posting gains of 6.19% and 3.79%, respectively.

Source: Terra

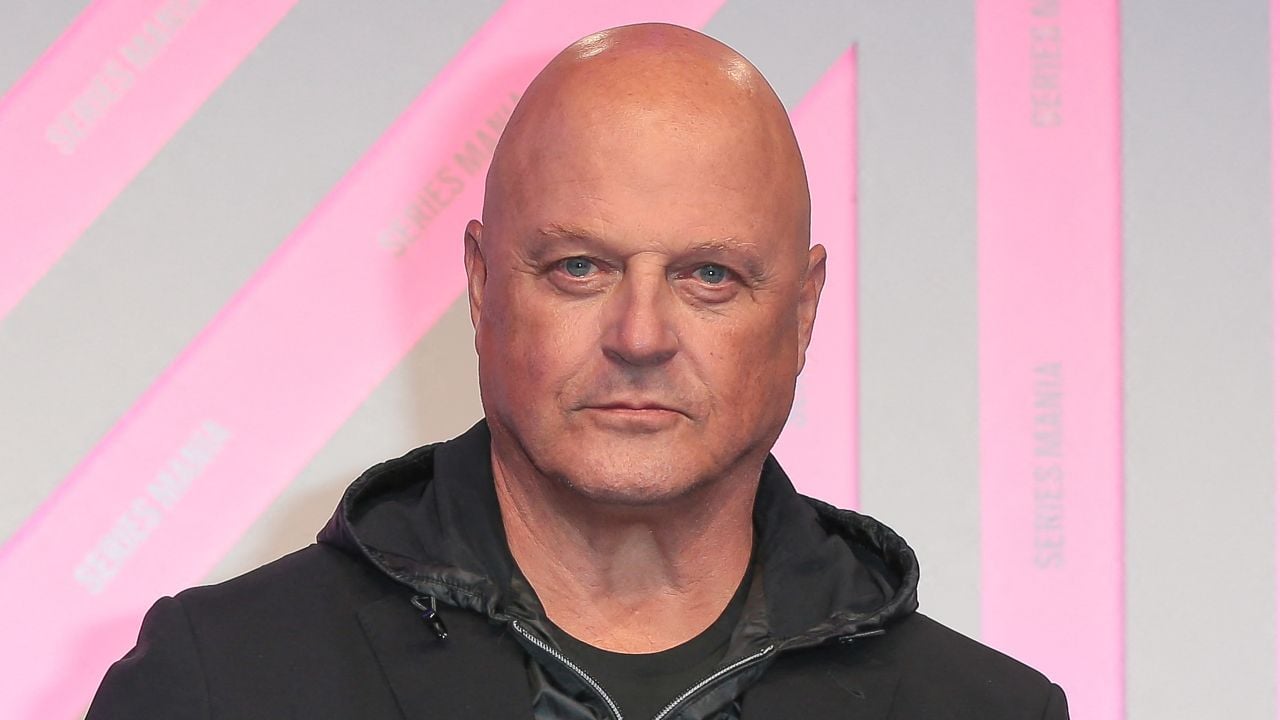

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.