-

Created in 2009, Bitcoin became one of the most precious active ingredients in the world. However, heavy economists have shown retra to the future of cryptocurrencies.

Photo: Michaelwuensch by Pixabay / Flipar

-

The forecasts on the future of the encryption are divided between fans of technological innovations and their application in the capital environment and those who see risks for economic stability.

Photo: Pixabay / Flipar 3D animation production company

-

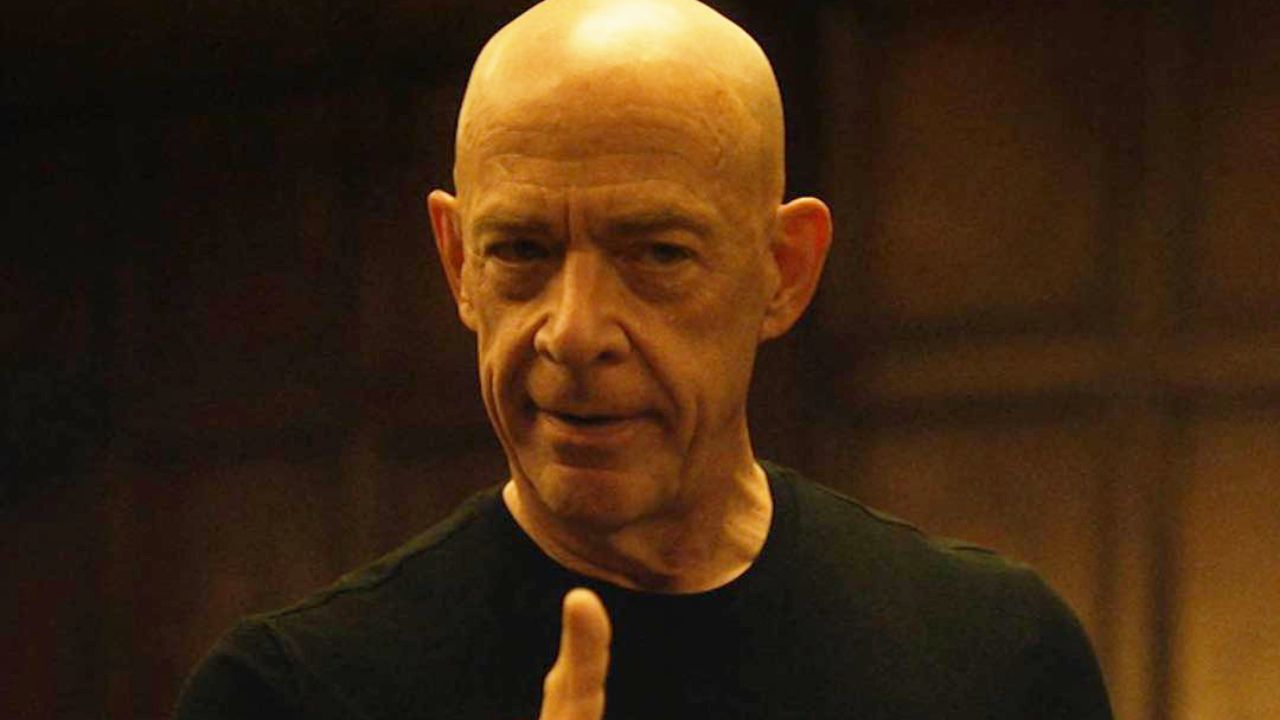

Winner of the Nobel Prize in 2013, Eugene Fama is on the list of experts showing a skeptical vision of the future of this resource.

Photo: Bengt Nyman Wikimedia Commons / Flipar

-

Fame issued his opinion by participating in a podcast on 30/1/2025. For the economist, cryptocurrencies have a “predictable end”.

Photo: Bengt Nyman – Flickr Wikimedia Commons / Flipar

-

“Cryptocurrencies are a mystery because they violate all the rules of a means of exchange. They do not have a real stable value. They have a truly variable value “, observed the American economist, who won the Nobel Prize together with Peter Hansen and Robert Schiller for pioneering work to identify trends in financial markets.

Photo: Eivind Pedersen / Pixabay / Flipar

-

“It is the type of change that should not be able to survive. I hope I burst out, but I can’t predict it. I hope so, because if we don’t explode we will need to start the entire monetary theory, “he added.

Photo: Image of Sergei Tokmakov, left https://terns.law by pixabay/flipar

-

That is, for fame the Bitcoin market and other cryptocurrencies is a bubble that broke out at some point. The forecast is based on traditional monetary theories.

Photo: Image of Roy Buri by Pixabay / Flipar

-

The economist believes that this collapse of the cryptocurrency market can take place up to a decade. Eugene Fama considers “unsustainable” that the global financial system migrates entirely to the blockchain networks so called. This is because it would require a huge computational capacity.

Photo: Pixabay / Flipar portal image

-

Another point mentioned by the economist is the volatility of cryptocurrencies as a means of exchange, without presenting a stable value.

Photo: Piro di Pixabay / Flipar

-

The traditional financial system has recorded a growth of the cryptocurrency market. But it is a constantly changing market – the aspect that traditional economists warn you as dangerous.

Photo: Image of Tamim Tarin by Pixabay / Flipar

-

In over 15 years of existence, Bitcoin has recorded ups and downs, which, of course, attracted investors and speculators.

Photo: Pete Linforh image of Pixabay / Flipar

-

In December 2024, Bitcoin advanced over $ 100,000 for the first time. But it is precisely the high volatility of the asset that generates questions in investors.

Photo: Alexander Gray Usplash / Flipar

-

To give you an idea, in 2017 Bitcoin reached $ 20,000 for the first time, but the following year he collapsed at $ 4,000.

Photo: Image of Sergei Tokmakov, left https://terns.law by pixabay/flipar

-

These high recurring highs and victims make economists like Eugene Fama show enthusiasm for the cryptocurrency market.

Photo: Image of Sergei Tokmakov, left https://terns.law by pixabay/flipar

-

Bitcoin, as well as other cryptocurrencies, is a decentralized resource. That is, it is not controlled by governments or central banks.

Photo: Dissemination / flipar

-

Initially, the idea was that it operated as a digital currency, but over time it was considered a speculative resource and a value reserve. Many compare it with digital gold.

Photo: Mastertux / Pixabay / Flipar

-

In 2021, El Salvador was the first country in the world to adopt Bitcoin as the official currency of the course together with the US dollar. In the announcement, President Nayib Bukele gave epic tones to the measure by saying that he would “revolutionize the economy”.

Photo: Presidenciasv / Wikimedia Commons / Flipar

-

The Salvadores started paying taxes on bitcoins, as well as using them in exchanges and services.

Photo: Bianca Holland / Pixabay / Flipar

-

However, less than four years later, on 29/1/2025, the Central American country removed the official currency status from Bitcoin. The measure was a consequence of the conditions imposed by the International Monetary Fund to borrow El Salvador.

Photo: Pouyana / Wikimedia Commons / Flipar

-

By decision of the legislative assembly controlled by the Government Party, the use was limited to the transactions between citizens and private companies. Furthermore, there is no longer the obligation to accept the cryptocurrency.

Photo: Eivind Pedersen / Pixabay / Flipar

Share

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.

![It All Begins Here: What’s in store for Monday 27th October 2025 Episode 1293 [SPOILERS] It All Begins Here: What’s in store for Monday 27th October 2025 Episode 1293 [SPOILERS]](https://fr.web.img6.acsta.net/img/41/39/413989e0bd493a6d9c6b47c276d6bcf1.jpg)