Analysts have raised doubts about the accusations that the new rates are mutual and are based on the rates applied by other countries in the United States.

The President of the United States Donald Trump has imposed a 10% rate on the goods imported from the United States by most countries, with even higher rates for those who consider the “worst transgressors”.

But how exactly these tax rates were calculated – which in practice act as import taxes?

Of the “complex” equation to the logic of the deficit

When Trump had a large cardboard table that detailed the rates in the rosette of the White House, it was supposed that the rates had been defined on the basis of the combination of existing rates and other commercial barriers, such as regulations.

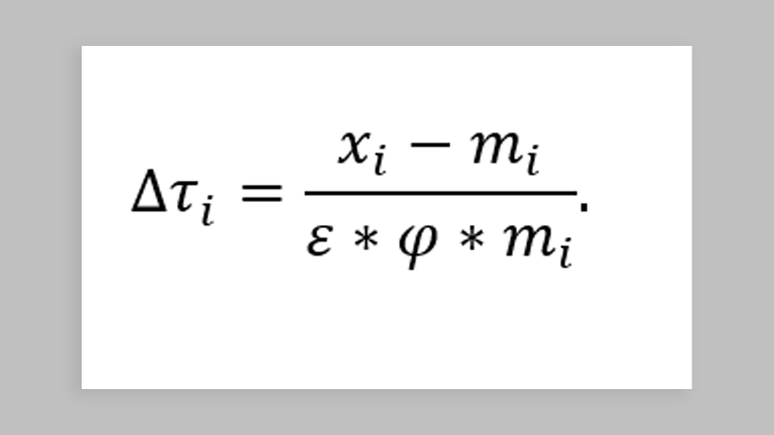

After the declaration, however, the administration released what seemed to be a very complex mathematical formula to explain how the technicians had reached the percentages applied to each country.

Using the equation, however, it is clear that it is reduced to a simple calculation: just take the commercial deficit of the United States in the assets with a particular country, divide it for the total imports of goods in that country and therefore divide this value for two.

The commercial deficit occurs when a country acquires more products from other countries than it sells (exports).

This is the case, for example, in the commercial relationship that the United States currently have with China. The difference between what Americans acquire in Chinese products and what they sell to the Asian country is $ 295 billion (about $ 1.65 trillion).

The total ownership number imported from China is $ 440 billion (about R $ 2.46 trillion).

Divide 295 for the 440, 67%are obtained, which, if divided by two and rounded, translates into 34%. So this was the rate imposed on China.

In the same way, when applying this formula to the European Union, the calculation of the White House led to a 20%rate.

Trump Fares “mutual”?

Many analysts stressed that these rates are not mutual.

A mutual rate would mean that it has been defined on which countries already charge from the United States, including existing rates and other commercial barriers that increase import costs such as regulations.

However, the official document of the White House on the methodology clarifies that the calculation has not been carried out for all countries that have undergone rates.

Instead, the rate was determined to eliminate the commercial deficit of the United States with each country.

Trump, however, deflected himself from the formula by imposing rates also to the countries that acquire multiple US products than they sell for them.

This is the case of the United Kingdom, for example the country with which the United States does not have a commercial deficit. However, the country was influenced by a 10%rate. The same happened with Brazil.

In total, more than 100 countries are subject to the new tariff regime.

‘Wider impacts’

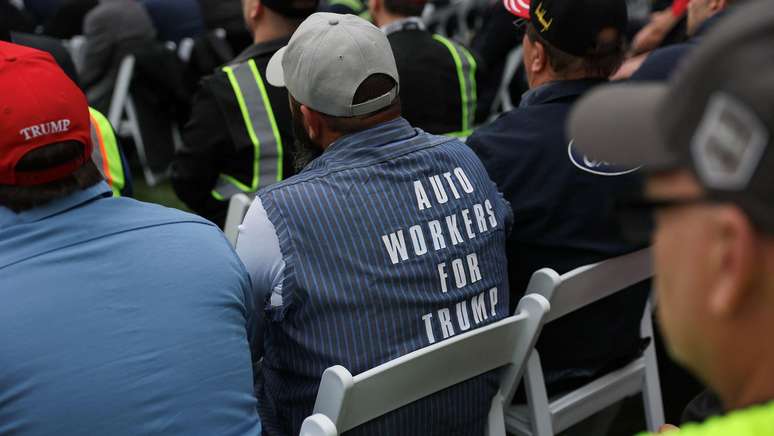

Trump believes the United States are at a disadvantage in global trade. In their opinion, other countries flood the US market with economic products, damaging local companies and eliminating jobs.

At the same time, these countries impose barriers that make products less competitive abroad.

With rates, Trump hopes to eliminate commercial deficits, revitalize the American industry and protect jobs.

But will this new tariff regime achieved the desired result?

The BBC Verify spoke with different economists and the predominant opinion is that while the rates can reduce the commercial deficit between the United States and some countries, they will not reduce the overall deficit with the rest of the world.

“Yes, this will reduce bilateral commercial deficits between the United States and these countries. But obviously there will be many wider impacts that are not captured in this calculation,” says Professor Jonathan Portes of King’s College London.

This is because the existing general deficit of the United States is not only caused by commercial barriers, but also by the way the American economy works.

Americans spend and invest more than they earn, for example, and this difference makes the United States buy more than they sell in the world.

As long as this dynamic exists, the country can continue with deficit, also with the increase in rates on its global commercial partners.

In addition, there are commercial deficits that exist for reasons that go beyond rates, such as the ease and the cost-effectiveness of the purchase of foods produced at lower costs in certain regions.

“The formula was made to justify the tariff collection compared to the countries with which the United States have a commercial deficit. There is no economic justification for this, and this will be expensive for the global economy,” says Thomas Sampson of the London School of Economics.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.