Find out what you need to do to get value and see what’s new in phase two

Brazilians with money “forgotten” in financial institutions will be able to request a withdrawal of the amount from 10am this Tuesday 7, through the second phase of the Receiving Value System (SVR).

According to data from the Central Bank (BC), there are more than R$6 billion pending withdrawal requests from 38.5 million individuals and 2.4 million legal entities. Despite the large amount, according to BC calculations, most beneficiaries have to redeem less than R$ 10.

Since the 28th, the system has released the site for consultations on the possible presence or absence of amounts to be received by the beneficiary. The query, however, did not specify the forgotten amount. During the withdrawal phase it will be possible to know its value.

The system was created to allow Brazilians to redeem the amounts left in bank accounts. See the step-by-step procedure for checking your balance and requesting money.

Find out if you forgot the money

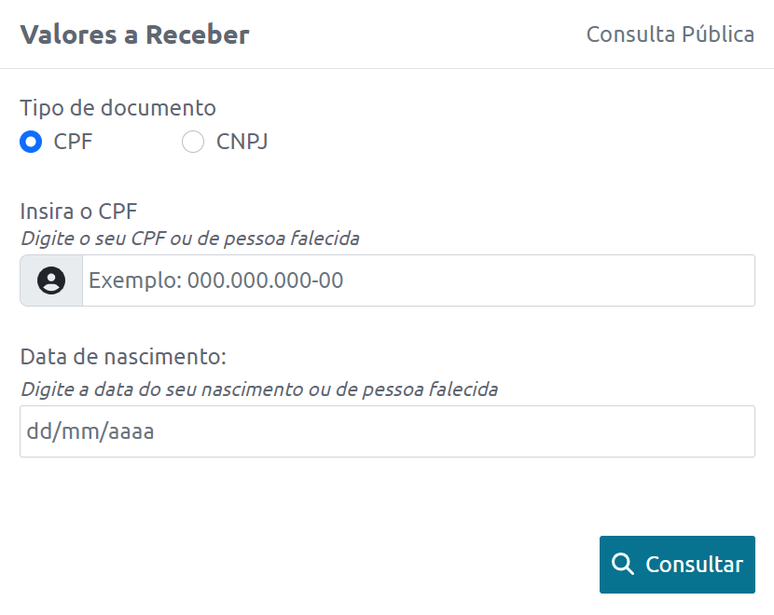

Through this link it will be possible to know if there is any amount to withdraw. Within the site, click on the “check if you have amounts to receive” button.

-1iuy8j3kbxb39.png)

A window will open asking you to consult your CPF or CNPJ number and date of birth (for individuals) or date of opening of the company (for legal entities).

At this stage, the system will only inform you whether or not there is an amount to withdraw from March 7th.

How to withdraw money

If you have credits, there will be a “login to SVR” button, and after clicking, you will be taken to your account page Gov.br. The BC informs the system that there is a possibility of a queue in this process.

The BC also detailed what each beneficiary will have 30 minutes within the system, to request the withdrawal, time which, according to the body, is sufficient to complete the process, but it is necessary to pay attention to a small clock that will appear in the upper corner of the screen.

What your Gov.br account must have

To access company values, the Gov.br account must have the CNPJ linked to it. In the case of individuals or deceased persons, the account must be silver or gold level. Find out how to proceed below:

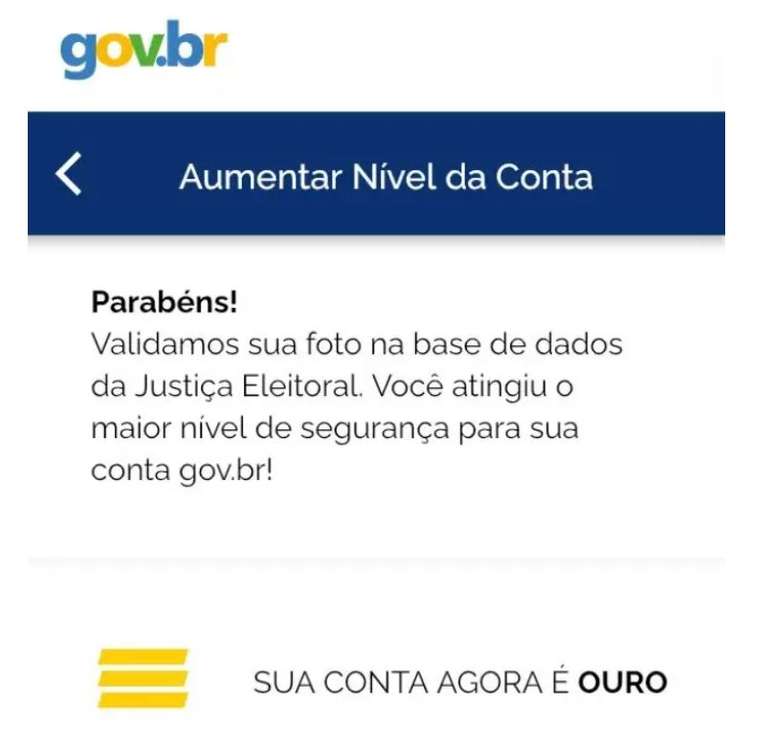

By default, every account created by Gov.br receives the Bronze Seal. There are online methods to level up, including through the application of the platform itself. A facial verification system may already be sufficient for this improvement.

To increase the level of security for the silver seal there are many ways to do this. To whom is registered Denatran, for example, you can use this data to obtain the silver seal, as the system will match the information with your CNH. Now who is a server, using the file data sigepe it is also possible to raise the level. There is also a third way, which is validation with a Bank online. Check the list if this option is possible with your bank.

Now to get the gold seal it is necessary to do Facial recognition. In this case, it is recommended to use the app gov.br for mobile phones, which will use your device’s camera for the process.

OR Earth he carried out the test with a silver account and requested the upgrade using the “level up” button, clearly visible at the top of the page.

Next, the system requests access to the camera so that it can perform facial recognition. You have to place your face in a space that is displayed in the app and stay that way for about three seconds, until recognition is complete. This way you get the golden seal, which is the highest level of security provided by the system.

Withdrawal Options

Once this process is completed, the system will give the beneficiary two withdrawal options:

• pix: In this case, there will be the option to “request it here”, i.e. the financial institution where your forgotten money is located gives you the option to receive this amount for Pix within 12 working days. You must inform the Pix key for the account you wish to receive. Tip: Always write down the protocol number if you need to speak to the institution.

• match: When the institution does not offer the option to profiteer via Pix, the system will inform a contact, by telephone or email, so that the beneficiary activates the financial institution and organizes the best way to receive the amount.

-

ASSISTANCE

Find out how to check if you forgot any money in the bank

-

ASSISTANCE

-1jekzw625wuuu.jpg)

How to captivate customers in Consumer Month?

-

ASSISTANCE

-s0v1k34hjltg.png)

The Bolsa Família program is relaunched with novelties and new values

-

ASSISTANCE

How to have discipline to save money?

The majority will receive less than R$ 10

The BC report points out that 29.2 million accounts, or 62.55% of the total, have less than R$10 in “forgotten” amounts to redeem. At the other extreme, only 643.1 thousand accounts, or 1.37% of the total, have values greater than R$ 1,000.01.

See below for the number of beneficiaries for each value range:

• Up to R$ 10: 29,282,110 accounts (62.55%);

• Between R$ 10.01 and R$ 100: 12,195,837 accounts (26.05%);

• Between R$ 100.01 and R$ 1,000: 4,694,862 accounts (10.03%);

• Over BRL 1,000.01: 643,105 accounts (1.37%).

The BC data also indicate that most of the valuables, R $ 3.1 billion, are in banks. Immediately after the consortium administrators, with 2.1 billion reais, and the cooperatives, with 602.7 million reais.

See below the total value of “forgotten” assets in each type of institution and the number of beneficiaries (the number refers to the total number of accounts, as a person can have multiple accounts with forgotten values):

• Banks: BRL 3,187,355,784.83 / Beneficiaries: 28,308,773

• Consortium administrators: BRL 2,149,913,448.90 / Beneficiaries: 8,901,738

• Cooperatives: BRL 602,764,641.30 / Beneficiaries: 2,437,485

• Payment Institutions: BRL 96,135,472.69 / Beneficiaries: 1,733,340

• Financial: BRL 40,286,992.88 / Beneficiaries: 3,078,240

• Brokers and distributors: BRL 9,464,761.52 / Beneficiaries: 11,791

• Others: BRL 1,920,882.18 / Beneficiaries: 192

Scam Warnings and Precautions

Some important points need to be highlighted. The first is that, in the event that the money is blocked, but you delay requesting a withdrawal, it won’t stop being yours. When you order it will be deposited. Until it’s done, it will stay there.

The second is that you have to be careful of don’t fall for the blows. The central bank has asked people not to access malicious links. This is the only link of the BC in which the values are consulted and, subsequently, requested for transfer.

In addition, the BC also warns that the service is free and that the organ does not contact you to discuss values or confirm your personal data. Only the institution that appears in the Credit System can contact you and do so it will never ask for your password. (*With information from Estadão Content)

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.

![New Day: Tarek and Tera Suspected Louise … Who Waiting You, on August 29, 2025 in the 45th Episode of Friday [SPOILERS] New Day: Tarek and Tera Suspected Louise … Who Waiting You, on August 29, 2025 in the 45th Episode of Friday [SPOILERS]](https://fr.web.img5.acsta.net/img/5a/82/5a8221afb0a9028b9c8d4ae3d631d41b.jpg)