Oil prices fell about $2 a barrel on Thursday to their lowest level since late March, weighed down by fears that a possible recession could hurt fuel demand and after a build-up in US gasoline inventories.

Brent crude finished at $81.10 a barrel, down $2.02 or 2.4%. US crude oil (WTI) finished at 77.29 a barrel, down $1.87, or 2.4%.

Both benchmark contracts fell 2% on Wednesday and are at their lowest level since just before OPEC+’s surprise announcement of further production cuts.

“At the end of the day, one of the main reasons we’re sliding is the fear of a recession,” said Bob Yawger, executive director of energy futures at Mizuho.

The number of Americans filing new jobless claims rose moderately last week, indicating the job market was slowing after a year of interest rate hikes by the US Federal Reserve and fueling worries about a slowdown in demand of fuel.

Gasoline inventories unexpectedly rose last week by 1.3 million barrels to 223.5 million barrels, the US Energy Information Administration said in its report Wednesday. [EIA/S] [API/S]

Implied gasoline demand also fell 3.9% from year-ago levels to 8.5 million barrels per day. Meanwhile, U.S. crude stockpiles fell by 4.6 million barrels, but analysts said the decline could be short-lived.

Source: Terra

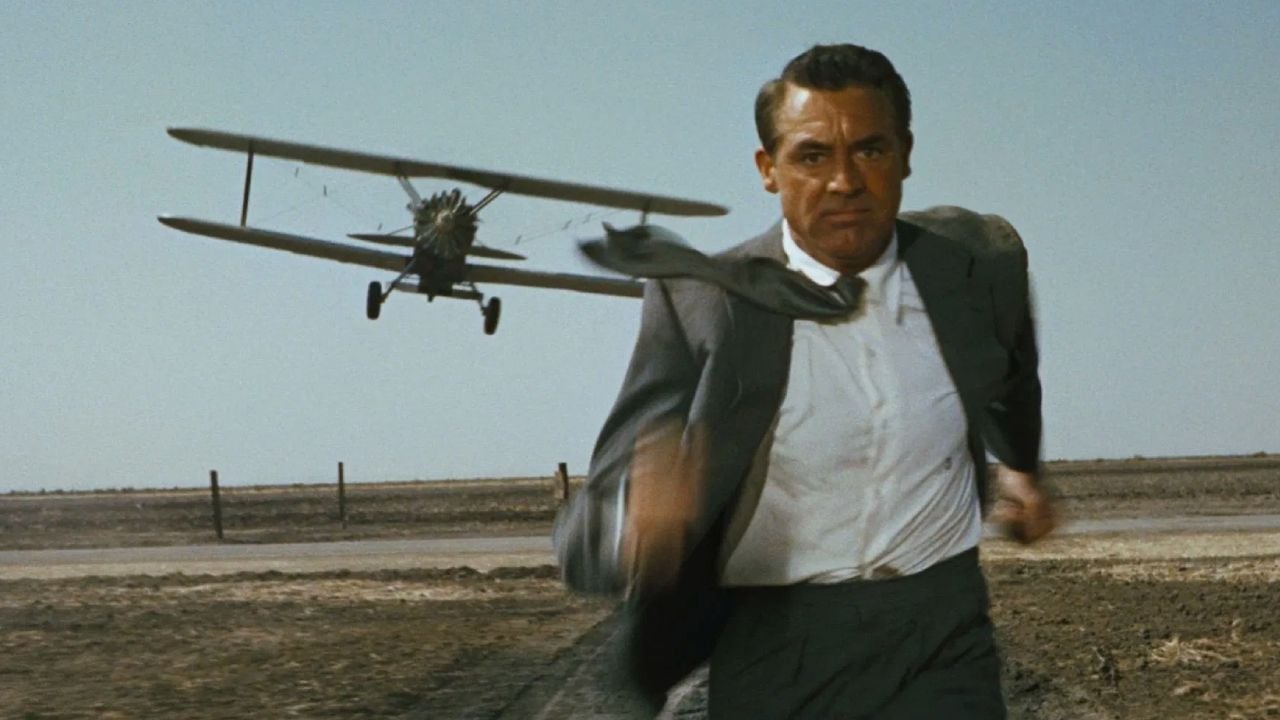

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.