Find out how to check your score in the Serasa app and see all the details about your financial life

Know your score Evening It is extremely important for a number of purposes, such as obtaining financing or accessing a credit card. By checking your CPF at the institution, you can find out if there are restrictions registered in your name, but also protests to the registry offices, legal actions or even obsolete registrations – which also weigh on the scoring system.

- How to subscribe to the Premium plan on Serasa

- Credit card that does not consult SPC and Serasa | 5 options

What is the Serasa score?

With an evocative name, the Serasa Score is nothing more than a credit scoring system that ranges from zero to 1 thousand and serves as an indicator of a person’s level of commitment to keeping their accounts updated. Banks, shops and companies usually consult the CPF or CNPJ to verify the situation before making concessions.

If your score is high, you have a better chance of getting credit and a variety of benefits. But if your name is “dirty” on the market, i.e. with a low score, in addition to not obtaining credit you are also prevented from accessing loans and other forms of acquisition, as you are considered a “bad payer”.

Some establishments even ignore the score level and make concessions for bad scores, but keep in mind that these places are not the majority and can still charge high interest and fees. Therefore, having all your debts under control is a guarantee that you will avoid these problems.

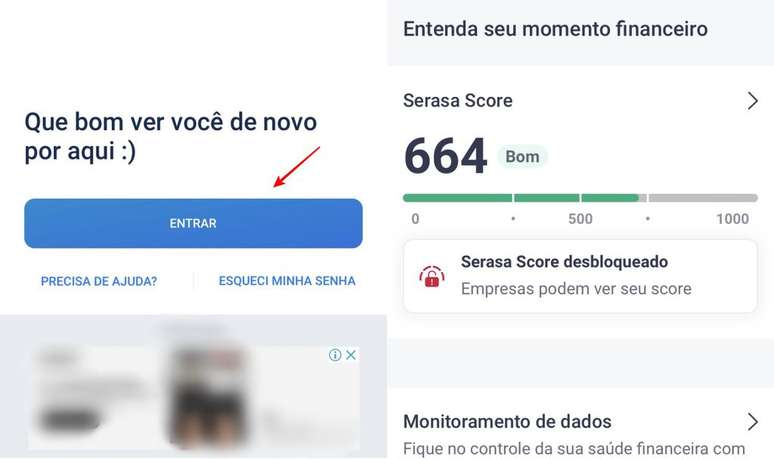

How to check your score on Serasa

Finding out your Serasa score is very simple: everything can be done via the institute’s app in just a few taps. If you are accessing the app for the first time, you need to create a registration. See instructions:

- Download the Serasa app (Android | iOS);

- Provide data to register;

- I created a password and accepted the terms of use;

- Scroll down the screen and check your score.

In addition to the score, the application allows you to check if there are any debts, protests, lawsuits or bad checks registered on your CPF. The tool also offers a dedicated debt renegotiation tab and even a digital wallet, if you want to pay electricity bills, water bills, bank receipts, etc.

What each result means

When you access your score in the Serasa app, you’re faced with a thermometer that indicates a score and whether that number is good or bad. There are four bands classified with colors and descriptions, which indicate the possibilities the user has of obtaining benefits such as loans and credits. Understanding each score:

- Very low: 0 to 300;

- Low: 301 to 500;

- Good: 501 to 700;

- High: 701 to 1000.

Low ratings indicate that the chances of a company granting credit are minimal or almost zero, while higher scores indicate the opposite: it is much easier and more likely to obtain credit, since the probability of default is low.

It is also important to note that, regardless of the outcome, nothing guarantees that a particular company will grant concessions. In some cases, the company may have its own rules and consider a person’s other information or even look at alternative scoring systems before approving any release.

If you have noticed that your score is not so good, see how to know if your name is on Serasa. OR Canaltech it also teaches what should be done clear your name at the institution and get rid of possible headaches.

Trends on Canaltech:

- NASA Highlights: Blue Moon, Nebulae, and + in Astronomy Photos of the Week

- Starlink: Video shows SpaceX satellite disintegrating in the atmosphere

- The human embryo is created without sperm or eggs

- What science says about the impact of a messy home on your health

- The City | How to watch shows live and online

- How much does Netflix cost? Plans, prices and payment methods

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.

-to4l92e9v7fo.jpg)