Immigrating to the United States at age 9 without speaking English, Jensen Huang founded Nvidia, one of the most valuable technology companies in the world.

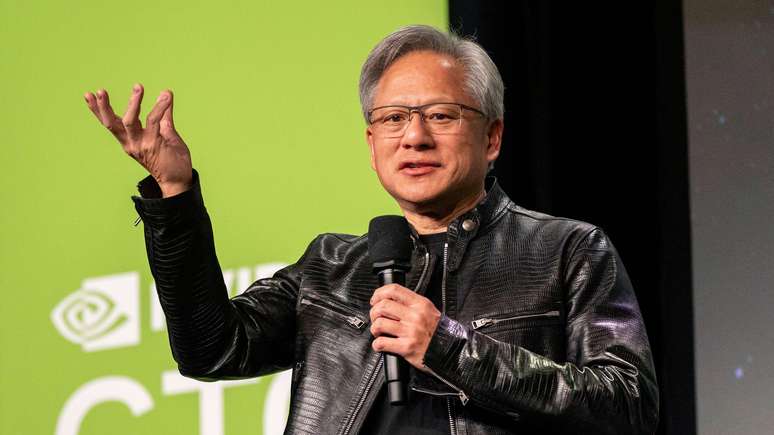

In the name of Nvidia, the company founded by Jensen Huang in 1993, three revealing elements mix: NV, for “new/next vision” (the vision of what is to come); VID, a reference to video – as the company started out focusing on the development of computer graphics cards –; but also the word “invidia”, which in Latin is used to refer to envy.

And, judging by the astonishing results that this technology company has achieved in the last year, it is likely that this is indeed the feeling that both the company and its founder have awakened in their competitors.

Between March 2023 and March 2024, Nvidia’s stock value jumped from $264 to $886, bringing its total valuation to more than $2 trillion and making it the third most valuable publicly traded company in the world, surpassing Alphabet ( Google), Amazon and Meta; and behind only Microsoft and Apple.

The rapid multiplication of Nvidia’s value can be explained by the fever surrounding artificial intelligence and the fact that this company supplies more than 70% of the chips that make this technology possible.

But these, in turn, would not exist if it were not for the vision of Huang, who bet on this market when it practically did not yet exist and, in this way, contributed to making it a reality.

Today, as Wired magazine recently declared, Huang is considered “the man of the moment, of the year and perhaps of the decade”; while Jim Cramer, investment analyst for the American network CNBC, said that the Nvidia founder surpasses Elon Musk as a visionary.

Huang’s story, however, was not without hardship, risk and hard work, including many hours spent cleaning bathrooms and waiting tables as a waiter.

Childhood in reform school

Jensen Huang was born in Taipei, the capital of Taiwan, in 1963.

He spent part of his childhood in his home country and in Thailand, until his parents decided to send him and his brother to the United States.

The boys spoke no English and were taken in by their uncles, also immigrants, who sent them to study at the Oneida Baptist Institute in Kentucky. At that time, the institution resembled a reformatory more than a regular school.

According to a bulletin published by the school in 2016, the two brothers were allowed to live, eat and work at the institution, which, at the time, offered only bachelor’s degrees. They attended classes at Oneida Elementary School.

Little Jensen Huang was in charge of cleaning the bathrooms.

“The kids were really difficult,” the entrepreneur commented in an interview with the American public radio station NPR in 2012. “They all had razors in their pockets and, when there were fights, it wasn’t nice to see. The kids got hurt .”

Despite all these difficulties, Huang always said that it was a great experience and that he enjoyed his time at the institute.

In 2016, he and his wife, Lori, donated $2 million (about R$10 million) for the construction of a building with classrooms and dormitories for girls at that educational center.

Hitting the jackpot

A few years later, the boys moved to Oregon. They were reunited with their parents, who also emigrated to the United States.

Huang attended Oregon State University where he studied electrical energy.

He says it was there that his eyes were opened to the “magic behind” computers. And it was always there that “luck” led him to meet his wife Lori, his study partner in the laboratory.

Lori was one of three students in a class with 80 students.

In a lecture given at the university in 2013, Huang pointed out that he also happened to know Nvidia’s two co-founders, Chris Malachowsky and Curtis Priem.

“In general, I’m saying the case is very important to success,” he said.

The three founders of Nvidia had the idea to create the company over breakfast at a Denny’s fast food chain in San José, California.

The snack bar received a plaque commemorating the incident, after, in 2023, the technology company was listed for the first time at a value of 1 trillion dollars (about R $ 5 trillion).

Huang has a long-standing relationship with Denny’s. It was at that chain’s coffee shop in Portland that he got his first job at age 15, washing dishes, cleaning tables and working as a waiter.

“Great career choice,” he said. “I highly recommend everyone to take their first job in the restaurant industry, which teaches you to be humble and work hard.”

Huang often comments that he was good at restaurant duties.

“My first job before being CEO [diretor-executivo] It was washing dishes, and I did very well,” he noted recently in a speech at the Stanford Graduate School of Business.

The businessman also said that working at Denny’s helped him overcome his extreme shyness. “I was horrified to have to talk to people,” he told the New York Times.

Betting on the unknown

Huang graduated as an engineer in 1984.

“A perfect year to graduate,” according to him. It was in that year that the era of personal computers began, with the launch of the first Mac computers.

He earned a master’s degree in electrical engineering from Stanford University. The course lasted eight years.

At the same time, he worked in various positions at technology companies, such as Advanced Micro Devices (AMD) and LSI Logic, which he left shortly before founding Nvidia.

In a 2013 speech at Oregon State University, he said that before creating the company, the three founders asked themselves three questions: Is this work something we “would really like” to do? Is it worth doing this job? Is this work “really hard” to do?

“Today I always ask myself the same questions,” he said. “Because you shouldn’t do anything you don’t love. And you should only work on the things that matter in your life.”

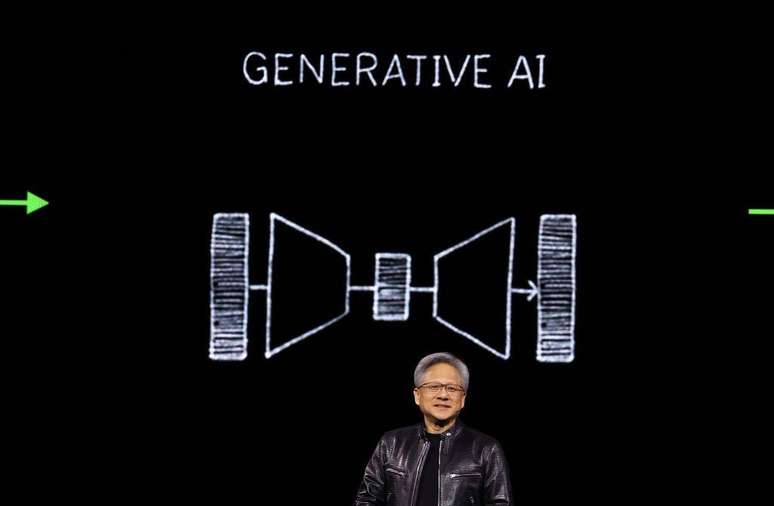

Part of your business philosophy is based on betting on these important things, even when there is no clear market.

“We find inspiration not in the size of the market, but in the importance of jobs, because the importance of jobs is an early indicator of the future market,” he said at the Stanford Graduate School of Business.

Huang also recommended that people constantly return to the basics. He assured that this creates many opportunities.

By applying these types of ideas, Huang created a company with a very horizontal structure. In it, more than 40 people report directly to him. And Huang also encourages cross-functional and bottom-up communication.

He explained that this is a way to facilitate the flow of ideas and information and also to stay up to date with the team’s best suggestions.

“Leading people to do great things, to inspire, empower and help others – these are the reasons the leadership team exists, to serve everyone else in the company,” he said during the Stanford speech.

Judging by Nvidia’s results, this philosophy works. But of course that hasn’t stopped the company from going through difficult times.

The first one arrived very quickly. After Nvidia spent the first two years looking for technological solutions to avoid the high price of DRAM memory, its price dropped by 90%.

This reduction made all the efforts invested useless and also opened the doors for dozens of other companies to start competing in the development of the best graphics chips.

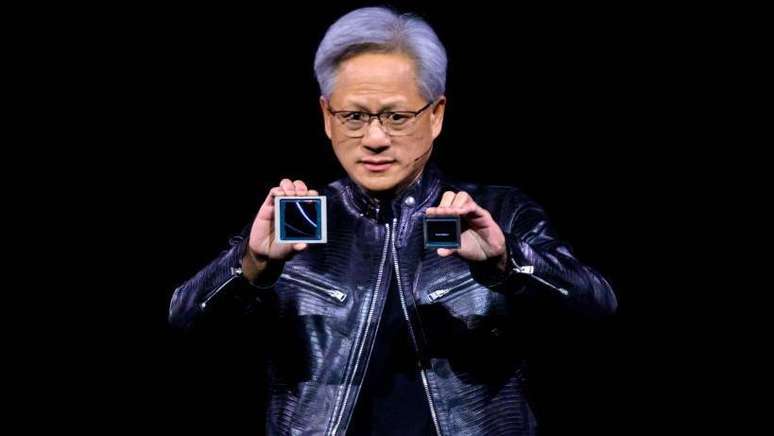

But Nvidia managed to refocus its efforts and, in 1999, launched the Graphics Processing Unit (GPU), a type of microprocessor that redefined computer games.

From then on the company continued to work on the development of GPU-accelerated computing, a model that takes advantage of the massive use of parallel graphics processors and allows you to accelerate the work of programs that require large computing power, such as analytics of data, simulations, visualizations and artificial intelligence.

The bet on artificial intelligence sent Nvidia’s stock price soaring, causing Huang’s personal fortune to reach $79 billion (about R$395 billion). With this, according to Forbes magazine, he became the 18th richest man in the world.

And Huang can go even further, thanks to Nvidia’s near-monopolistic position in the production of these superchips. Predictions are that demand will continue to grow in the near future.

As one Wall Street analyst pointed out in The New Yorker magazine, “there’s a war going on in artificial intelligence, and Nvidia is the only seller of weapons.”

It seems that Jensen Huang’s luck may continue to improve in the future.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.