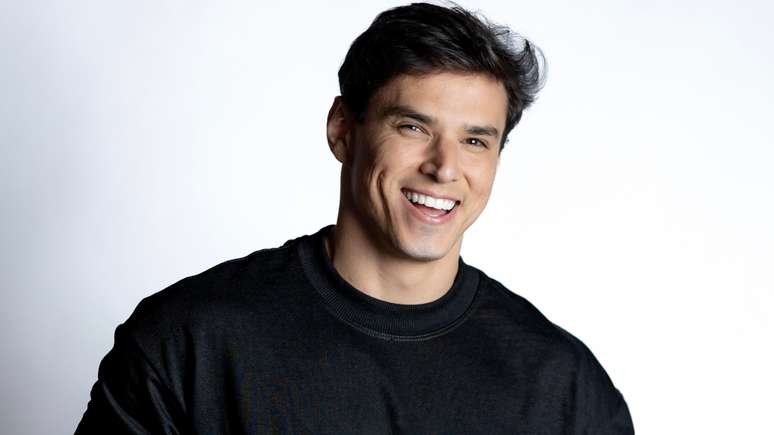

Geru expert discusses the impact of low scores on access to financial resources

Summary

Maintaining a good credit score is essential to getting better financing, employment and rental conditions, according to Serasa Experian and Cristiano Rocha, of Geru.

Maintaining a good credit score is essential to secure better financing conditions, get loans with lower interest rates, and even to find a job or rent a property. According to data from Serasa Experian, a good score is above 501 points, while the ideal is above 701 points.

For Cristiano Rocha, CRO of GeruFintech credit for people and companies committed to their future and Open Co group brand, well beyond paying bills on time, there are other good practices that can help improve the rating.

“Credit should not only be used to pay off debts, but also as an incentive for those who want to achieve something or fulfill a dream, such as a planned trip or an investment to prosper in business. However, to get good opportunities, whether the borrower is an individual or a company, it is essential to have a good track record,” he analyzes.

Below, the expert presents five ways to increase your score and get good opportunities.

Using Credit Responsibly

Avoiding using the entire credit limit is an effective way to demonstrate financial balance. “It is recommended to use less than 30% of the available limit on the cards. This demonstrates to creditors that the consumer knows how to manage his finances responsibly, with balance,” teaches the CRO.

Keep old accounts active

Old accounts with good payment histories are valuable for history analysis. “In this age of data-driven intelligence, not closing these accounts is a way to demonstrate your ability to manage your credit over time,” Rocha says.

Diversify your credit sources

Contrary to common sense, having different types of credit, such as cards, personal loans and financing, can be positive, as long as they are well managed. “Following the rule of limiting 30% of the family budget to financial products shows that the person can manage what he or she earns,” the executive guarantees.

Negotiate debts

If you are having trouble paying a debt, contact your creditor to negotiate a solution. “Renegotiating old debts can prevent defaults already recorded from having an even more negative impact on the story,” the executive explains.

Get added as an authorized user

Asking a trusted friend or family member with a good credit history to add you as an authorized user on one of their cards is a way to confirm your good credit history. “The positive history of this card will be reflected in your report, helping you get a better score,” Rocha concludes.

inspires transformation in the world of work, in business, in society. Compasso, a content and connection agency, is born.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.