“The market requires predictability, but it wants an acceleration of import rates,” says an expert from Bright Consulting in this article

Much has been said about the growth of vehicle imports from China and the measures to limit such imports, which end up replacing vehicles produced here. The most eloquent statement comes from Anfavea and the MDICS responded that the issue is being studied.

This article summarizes the steps taken so far and discusses the appropriateness of path reviews along the way.

The import tax exemption for electrified vehicles – total exemption for BEVs and almost total exemption for HEVs and PHEVs – emerged in 2015 as a way to bring the technology to Brazil and allow brands, infrastructure networks and customers to have their first experiences of using it in the country. Until 2023, the effects achieved were exactly those envisaged by the measure.

Motivated by excess production capacity in their country and the pursuit of markets with low penetration of electrified vehicles, two major Chinese brands set up subsidiaries in the country in 2022 and began a strong sales acceleration starting from May 2023. Customers were attracted through vigorous marketing campaigns and extensive warranty terms for high-tech and affordable vehicles.

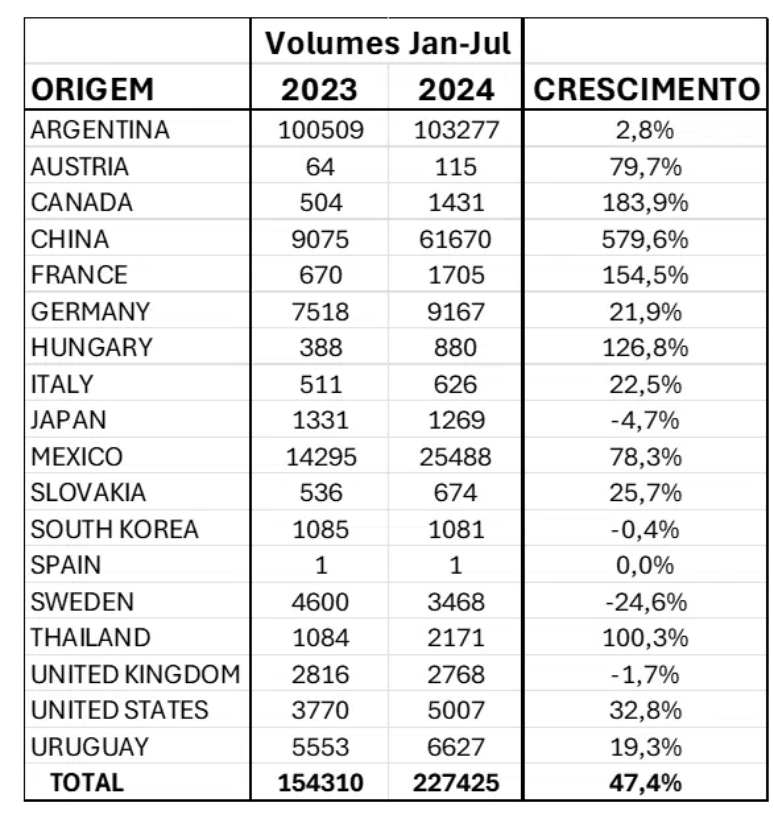

Imported vehicle volumes increased 47% from the first 7 months of 2023 to the same period in 2024. Over 35% of imported vehicles are electrified in some way, and this increase in imports occurred in virtually all countries of origin, except Argentina. With Chinese vehicles selling 6 times the volume sold in 2023 in 2014, as can be seen in the table below, extracted from Bright Consulting’s AutoDash platform.

This means that while Chinese manufacturers have been more aggressively exploring this partial import tax exemption, many other brands are enjoying the same benefits by bringing their own electrified vehicles.

Quickly summarizing the legislative change, the Gecex-Camex Ordinance published on November 23, 2023 gradually reinstated the original import tax for these products, with rates gradually increasing to 35% in July 2026. At this time, electrified imports pay 25%, 20% and 18% for PHEV, HEV and BEV technologies, respectively.

All these rates will reach 35% in July 2026, with a new intermediate increase in July 2025. Within the same ordinance, duty-free import quotas have been granted for each phase of the program. At present, the quota corresponds to approximately 20% of the volume sold in the period and benefits companies with a consolidated history of importing.

Using the ruler, it seems that the tax change was reinstated as soon as it became clear that the import volumes of electrified could grow significantly from 2024 onwards. The current question is whether the gradual growth of the tax rate should be accelerated or not, let’s say, reaching the maximum already in January 2025.

For BEVs, the most affected technology path, this would mean a 14% increase in the cost of imported vehicles, leaving each brand to decide how much to pass on to the final price. For HEVs and PHEVs, the increase would be 12% and 8% respectively.

The gradual increase in import taxes was implemented to allow manufacturers sufficient time to set up factories in the country, and Chinese brands responsible for the sharp increase in imported volumes have already communicated solid local investment and production plans, starting with CKD assembly and moving towards gradual localization.

It should not be forgotten that local content will initially be limited due to the unavailability of local suppliers for some technologies and will be affected by increased import taxes.

Should we anticipate the tax increase? Will this anticipation lead to a reduction in the volumes of imported electrified vehicles? According to experts at Bright Consulting, volumes will remain virtually unchanged, with new brands absorbing the incremental cost within their investment plans.

Import growth in 2024 will be around 24% as the acceleration of imports occurred in the second half of 2023. In other words, it will make it difficult for companies to invest in Brazil without any benefit for companies that already produce here. In addition, it will be a change in the rules of the game, which all companies have reported as a crucial behavior in Brazil.

The industry always requires predictability. We need to maintain it in all aspects. The change in import taxes is already underway and it is proving to be a sufficient obstacle for the sale of low-cost vehicles here. For premium vehicles, the 35% import tax has not prevented the sale of combustion vehicles.

Let’s let the current fare increases continue and focus our attention on the goals of the Mover program, which already supports investment in research and development and must now determine the efficiency and safety goals that have always brought benefits to both industry and consumers.

–

Cassio Pagliarini, CMO of Bright Consulting, originally published this text in the automotive consulting firm’s News Letter.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.