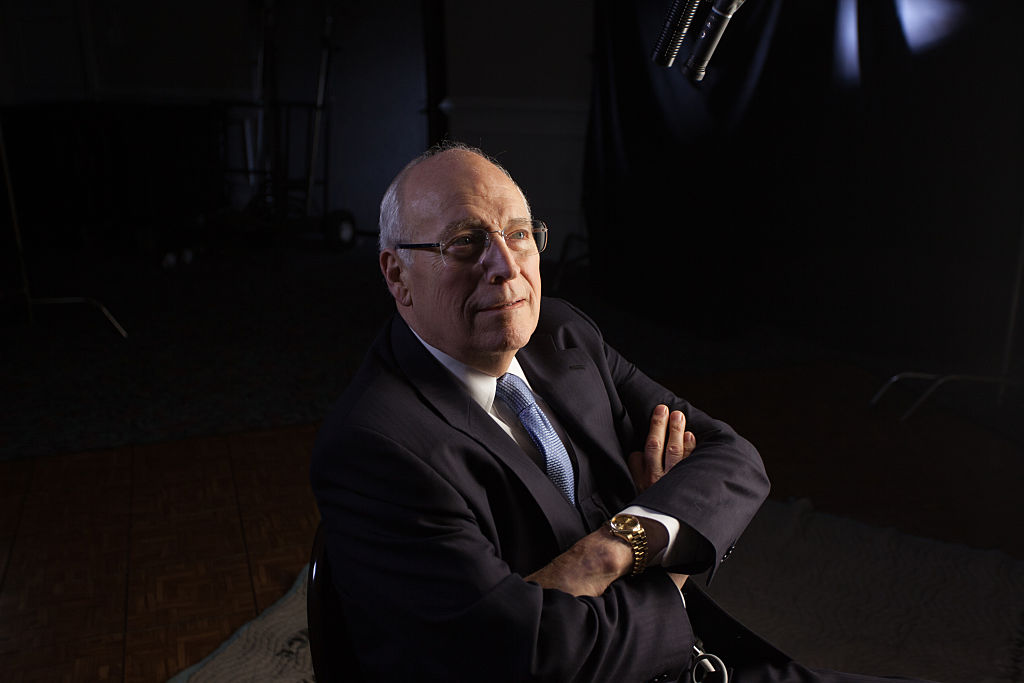

Central Bank President Roberto Campos Neto said on Thursday that the recent increase in forward curve premiums could be explained by the perceived lack of fiscal transparency from the government, but that the situation was not as bad as in other countries.

Longer-term interbank deposit (DI) rates rose steadily on Friday and Monday, with the market incorporating more premiums into the curve amid doubts over Lula’s government’s ability to balance public finances.

Last Tuesday, Campos Neto himself said that this increase in the risk premium seemed “exaggerated” due to the country’s fiscal figures.

Asked on Thursday whether the “exaggeration” had already been removed from the curve in recent days, Campos Neto limited himself to explaining his point of view on the recent movement.

“What I said was that we had the perception that the market seemed uncomfortable with fiscal transparency, which generated risk aversion,” Campos Neto commented at a press conference in Sao Paulo.

According to him, comparing Brazil’s data with those of other emerging countries, one can see a fiscal expansion, but the domestic numbers are not much worse.

“This increase in premiums is explained by the perception of less fiscal transparency,” Campos Neto said, adding that the situation compared to other countries “is not that bad.”

During the press conference, Campos Neto also avoided saying whether the central bank’s fiscal projections are close to those of the government – which is more optimistic about reaching the fiscal target – or those of the market, which has forecast larger primary deficits.

He recalled that the BC does not publish fiscal projections, but stressed that the authority follows international criteria to calculate the data.

The Central Bank published its inflation report this Thursday morning, with projections for economic variables such as price indices, gross domestic product, credit and external accounts.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.