Shares on a Reddit social networking forum on the stock exchange sent a near-bankrupt retailer to raise the stock and drove investors crazy in January 2021

Some call it opportunism and speculation, others a move by small investors on the stock exchange against the big companies in the sector and a middle finger for the stock market as a whole. Whichever side of the approach you are on, the truth is that recent history of GameStop has gone down in history, and not because of its trajectory as one of the largest video game retailers in the world.

- Understand why Nubank and other companies abandoned the Sao Paulo Stock Exchange

- The 10 best documentaries available on Netflix

The real story, January 2021is the theme of GameStop versus Wall Streeta new series of documentaries by Netflix which will debut on September 28th. In three episodes released at once on the streaming service, we will discover how a group of the social network Reddit managed to reverse the logic of the stock market, to the point of leaving the experts desperate, breaking movement records and even attracting the attention of the House. White. .

& nbsp;

Between strong words like “destroy the economy” and “steal from the rich to give to the poor”, along with trolling and a lot of Internet culture, there is a plot of enrichment and movement of millions of dollars in stocks. The difference is that, at that time, all that money didn’t go into the pockets of the usual seeds.

Earn money at low cost

The most basic and common idea of the stock market is to buy the shares of a company for a value and sell them, generating profit, at a higher price, after appreciation. Following the news in search of possible movements or a favorable economic scenario or not is seen as the standard way to understand the movements of the stock market, which many also understand as a bet on an industry that is very susceptible to emotions and herd behavior.

However, this is not the only way to make money in the market. Another possibility is the so-called “short trade”, or short stock in English: a strange name that indicates the bet on the fall of a stock. This is a high-risk operation, or not, in the case of a large game retailer that already suffered from the digital distribution of games and saw, with the pandemic and physical stores closed, bankruptcy on the horizon.

It works like a rental, as explained by XP Investimentos in the video above. Investors, in this case a company called Melvin Capital, bet on GameStop to go down and put options on the stock, selling them on behalf of their owners and paying them a commission, keeping the difference. It’s a perfectly legal move, albeit frowned upon by day traders, individual investors who trade on the stock exchange from home, from their computers.

They gathered on a Reddit forum called Wall Street Bets, where they analyzed the market and pointed to the most profitable stocks to buy or sell. When Melvin Capital’s gamble on GameStop’s downfall came to light, insiders decided to troll the market, massively buying the retailer’s stock and starting a chain of events that resulted in losses for the powerful and gains for ordinary people.

A lot of money changing hands

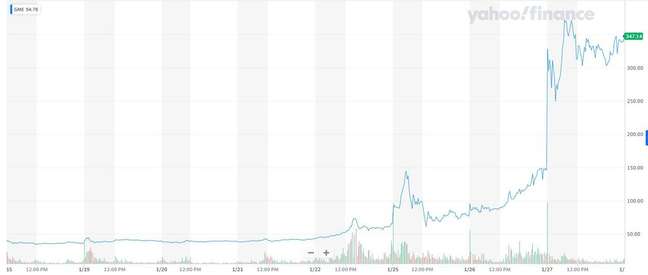

When the move began on January 27, 2021, GameStop shares were trading below the $ 20 threshold. At the end of trading, they were worth US $ 454, or about R $ 2,380 in a direct conversion, and have continued to rise. after market close, in transactions that would be calculated the next day.

Meanwhile, on Wall Street Bets, users who participated in the first wave celebrated the profitable investment, which would have served to buy a home of their own or pay off student debts. All, above all, perfectly legal, since, despite being a combined action, the purchase of shares can be made by anyone at any time. Again, what you saw was good old financial speculation, but made by different people than usual.

The fire took on even greater proportions when Elon Muskentrepreneur and owner of companies such as Tesla And SpaceX, he tweeted about it. Using a well-known meme and a single word, she showed the way of the problem to analysts who pushed themselves on the television networks trying to understand what was going on and brought more people into a wave that seemed to continue to grow.

Given the proportion of the gains, Wall Street Bets quickly began looking for other short stocks that could generate similar profits. On the same January 27, the American cinema chain AMC saw its shares on the stock exchange more than triple in value, while the network of former Blockbuster rental companies saw its shares appreciate by more than 700% while it was in liquidation. .

Meanwhile, investors who bet on these companies’ short stocks have seen their market value plummet. It is estimated that, in the week of the so-called “Gamestonk”, only Melvin Capital has lost more than 30% of its market value, as have other companies in the sector. It was then that the eyes of the suits widened.

Savings at stake (or not)

Nobody cares when a citizen loses money after doing business. But when it comes to powerful people, with expensive ties and ties, things change, and that’s exactly what happened in the hours and days that followed the movement unleashed by the Wall Street Bets.

After all, what we saw the day before was the record volume of transactions on the US stock exchanges, a sign that remains to this day, and the third largest movement of dollars in the history of the trading session. The day, on the other hand, closed at a low of 2% and there was a lot of fear for the volatility of the market, if the accelerated movement continued in the following days.

The next day, January 28, the United States Securities and Exchange Commission called for a 10-day freeze on buying and selling of GameStop shares to stop the upward and downward movement of the stock exchanges and their investors. . Meanwhile, day-trading apps have auto-locked the dealer’s stock trading, angering individual investors and making it clear who ultimately protects the market.

Meanwhile, in a statement, White House press secretary Jen Psaki said Joe Biden himself was monitoring the situation with his economics experts. The statement, however, came in a calm tone, as the idea was that the stock market wasn’t the only indicator of the country’s financial health and accompanied the idea that the frenzy wouldn’t be long.

And that was it. A week later, GameStop shares were already trading at US $ 82, around R $ 431, and continued to decline until the return to normal. The combined moves on the internet would lead to new sudden increases in the reseller’s shares between January and March 2021, but in a move nowhere near the one seen previously. The market, after all, was vaccinated.

The reflections of January 2021 are still being felt today. In June 2022, a US House Financial Services Committee sent a 140-page document to the Securities and Exchange Commission calling for stricter rules for buying and selling shares of liquidated or short-listed companies. Meanwhile, in the Senate, Democrats are positioning themselves in favor of a stock exchange tax to prevent speculation and herd movement.

It is a story still in the making which, as mentioned, will be told in three chapters. GameStop versus Wall Street will debut on Wednesday 28 September exclusively on Netflix. The original production is directed by Theo Love (The legend of the Po island) and produced by Liz Garbus (What happened, Miss Simone?) and Dan Cogan (The invitation).

Trend on Canaltech:

- The 10 most brutal gameplay scenes in games

- House of the Dragon │ Why doesn’t Prince Aemond Targaryen have a dragon?

- The fast radio blast in another galaxy is one of the strangest ever seen

- DART: NASA crashes a spaceship into the asteroid Dimorphos in a historical broadcast

- Asteroid Map: The simulator shows the damage an asteroid would do to your city

+The best content in your email for free. Choose your favorite Earth Newsletter. Click here!

Source: Terra

Emily Jhon is a product and service reviewer at Gossipify, known for her honest evaluations and thorough analysis. With a background in marketing and consumer research, she offers valuable insights to readers. She has been writing for Gossipify for several years and has a degree in Marketing and Consumer Research from the University of Oxford.