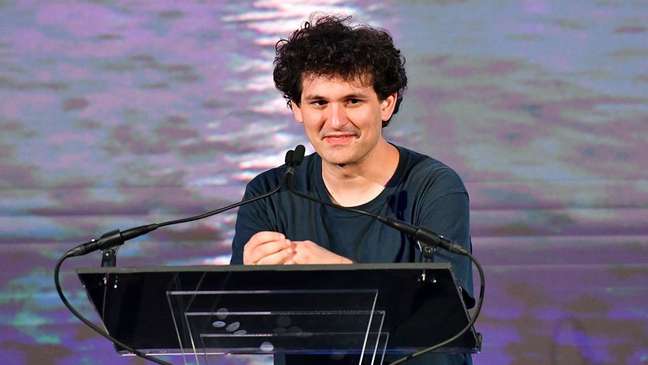

Prosecutors in the United States have indicted businessman Sam Bankman-Fried for fraud that contributed to the demise of FTX, one of the largest cryptocurrency firms in the world.

Known as the “king of cryptocurrencies,” businessman Sam Bankman-Fried was indicted by US prosecutors on Tuesday.

He faces eight criminal charges after being arrested Monday night in the Bahamas.

The indictment against the founder and former CEO of cryptocurrency platform FTX includes felonies including conspiracy to defraud the United States, wire fraud, securities fraud and money laundering.

A federal court in Manhattan, New York, announced the 30-year-old businessman was charged with misusing hundreds of millions of dollars of funds from his company’s clients.

FTX, one of the largest cryptocurrency companies in the world, collapsed last month, affecting the entire cryptocurrency market.

The allegations point out that he played a central role in the precipitous fall of FTX and that he hid his financial woes from the public and investors.

Sam Bankman-Fried was also accused of violating campaign finance laws, a charge that could have far-reaching repercussions since Bankman-Fried was one of this year’s largest political donors.

These allegations are added to those already announced by the Securities and Exchange Commission, according to which the entrepreneur defrauded investors and used his resources to buy real estate in his name and that of his family, according to a complaint made public by the Attorney General of the Republic. United States, in New York. .

Bankman-Fried was arrested in the Bahamas on Monday and is expected to be extradited to the United States. He denies committing any fraud, although he acknowledged in a BBC interview that he was “not as competent as I thought”.

His legal team released a statement saying they were looking into the allegations “and considering all of his legal options.”

House of cards

Bankman-Fried has built a “house of cards based on fraud,” said Gary Gensler, chairman of the US Securities and Exchange Commission.

Gensler added that the allegations were also a call for other platforms to comply with US law.

FTX filed for bankruptcy in the US, leaving thousands of customers unable to withdraw their money invested in the market.

At the height of his business and success, Bankman-Fried was referred to as a “younger version” of longtime American investor Warren Buffett, one of the richest men in the world.

At the end of October, Bankman-Fried had an estimated net worth of more than $15 billion.

However, according to his version of events, he underestimated the large amount of money needed to cover withdrawals from FTX clients, causing investors to panic.

Many American digital currency companies have struggled with the country’s shrinking economy and concerns about the viability of cryptocurrencies in general.

Bankman-Fried resigned as CEO of FTX on Nov. 11.

According to court documents from earlier this month, FTX currently owes its top 50 creditors nearly $3.1 billion.

🇧🇷The best content in your email for free. Choose your favorite Terra newsletter. Click here!

Source: Terra

Camila Luna is a writer at Gossipify, where she covers the latest movies and television series. With a passion for all things entertainment, Camila brings her unique perspective to her writing and offers readers an inside look at the industry. Camila is a graduate from the University of California, Los Angeles (UCLA) with a degree in English and is also a avid movie watcher.