Opening a Nubank account for someone under the age of 18 is simple and can be done in the Nubank app; see how to proceed

A doubt that may arise among young people is at what age an account can be opened Nubank. To start the financial journey, people under the age of majority must meet some essential requirements.

What is the minimum age to open a Nubank account?

Teens aged 10 to 17 can have their own Nubank account with parental consent. With an open digital account you can:

- Have a card with a debit function;

- Save money in Boxes to make money with the RDB;

- Recharge your mobile directly in the application;

- Use the PIX;

- activate the Street mode and ensure greater protection of the app against theft and theft of the mobile.

Also, it is important to note that the process of opening an account for this age group requires an application from the father or mother, as children under 18 cannot apply for an account or debit card on their own.

If legal guardians are not yet Nubank customers, they must open an account before proceeding with the application on behalf of the children.

How to request the opening of an account for minors under 18?

The process of opening an account for a teenager is simple and can be done through the Nubank application of the legal guardian, be it the father or mother. After that, an invitation is sent to the child. Watch:

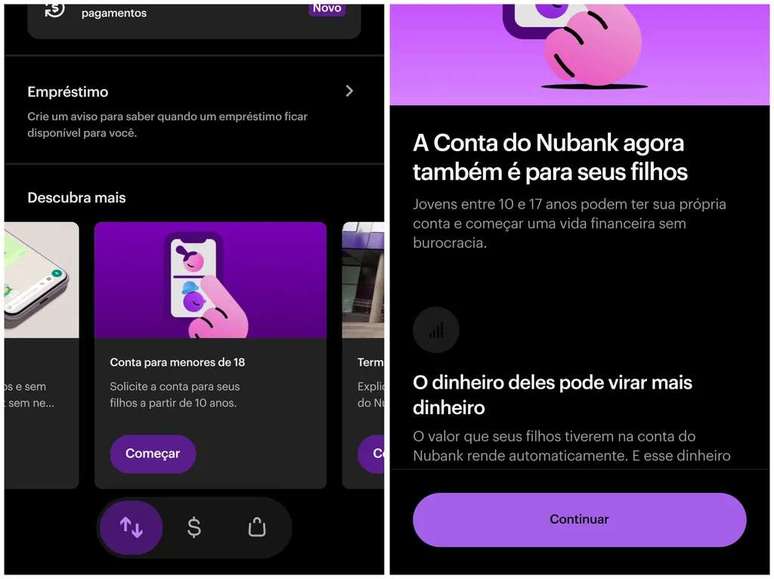

- Open the Nubank app;

- Scroll down to the “Learn more” section;

- Select the “Get started” option under “Under 18 accounts”;

- Enter the data of the person under 18 who wants to open an account;

- Accept the account agreement;

- Enter your 4-digit password.

After following these steps, an invitation is sent to the child under 18’s email address. Subsequently, the person must click on the link, download the Nubank application on the mobile phone and follow the instructions on the screen to proceed with the opening of the account.

Is it worth opening an account for under 18s?

According to Nubank, opening an account for a child under the age of 18 can be beneficial for teaching organization and financial control. A controlled environment is one of the steps to teaching money management.

Furthermore, an account opened for the teenager can be used to send allowances and request the debit function to make spending practical. It is not possible to apply for a credit card before the age of 18.

If you want to know how to invest money in the account, check it out how much does the Nubank box make.

Trending on Canaltech:

- The Chandrayaan-3 probe performs another maneuver and approaches the Moon

- Elon Musk considers trading fight with Mark Zuckerberg for verbal debate

- Variant BA.6: scientist recommends returning to anti-covid masks

- 10 References and Easter Eggs in Thor: Love and Thunder

- Disney+ wants to end password sharing

- State of SP installs unauthorized apps on teachers’ and students’ cell phones

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.

![Tomorrow Belongs to Us: What’s in store for Monday 3 November 2025 Episode 2066 [SPOILERS] Tomorrow Belongs to Us: What’s in store for Monday 3 November 2025 Episode 2066 [SPOILERS]](https://fr.web.img3.acsta.net/img/90/4b/904bf0916a3afede10b3575c799a9882.jpg)