Purchases made on the Aliexpress, Shein and Shopee platforms decrease by over 50%

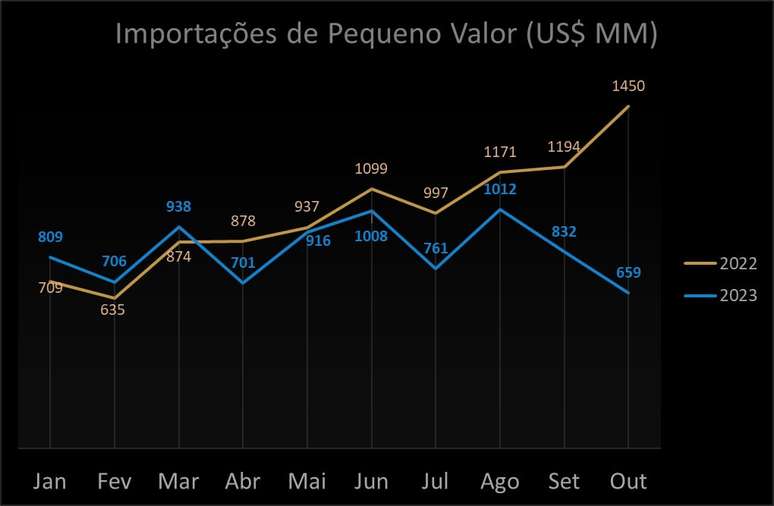

Last October, imports of low-value products, a category that includes those purchased on e-commerce platforms such as Aliexpress, Shein and Shopee, recorded the largest decline of the year with a drop of 54.5% compared to the same month of 2022.

In total, the imported value reached $659 million in October 2023, up from $1.4 million in 2022. The survey was conducted by Vixtra, a foreign trade fintech, based on data published by Central Bank in the first week of December.

This is the largest drop since the government began discussing the possible taxation of these products in April this year. In August, the first month in which the new tax rules for these products came into force, imports grew by 32.9% compared to the previous month. However, compared to the same month in 2022, a decline of 13.6% was recorded in the period.

From September onwards there was a more pronounced decline. That month, imports fell 30.3% and reached $832 million – in absolute numbers the drop was $361. In October, the most recent data made available by Bacen reveals that the decline continued and grew even further. In numbers, the decline was 54.5% and reached $659 million; in absolute numbers the decline was $791 million.

Taxes, taxes and more taxes

Leonardo Baltieri, co-CEO of Vixtra, believes that taxation is primarily responsible for the reduction.

“When consumers started getting taxed and reports spread on social media, many people started to be afraid to buy on these platforms or even avoid them,” he says. “Consumers are attracted by the cheaper prices offered by these companies, with the taxation of these products, many are starting to wonder if it still makes sense to purchase them through these channels. Under the new rules, goods priced under US$50 have no import taxes, but are still subject to the 17% ICMS. For products over US$50, the values practically double, as they are subject to a 60% tax rate, in addition to the 17% ICMS.

There was also a decline in the annual cumulative figure, although more limited. In the first ten months of this year, 8.3 billion dollars were imported, a decrease of 16.12% compared to the same period last year, when it reached 9.9 billion dollars. In absolute numbers, the drop is $1.6 billion less.

“Despite the decline, these types of imports still generate billions every year and will likely continue to do so for some time. However, the new tax rules will have to contain the strong growth that these operations have continued to record in recent years”, explains Baltieri.

“The cost-benefit ratio will continue to be the main key factor in making these purchases by the end consumer,” he concludes.

inspires transformation in the world of work, in business, in society. Compasso, a content and connection agency, is born.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.