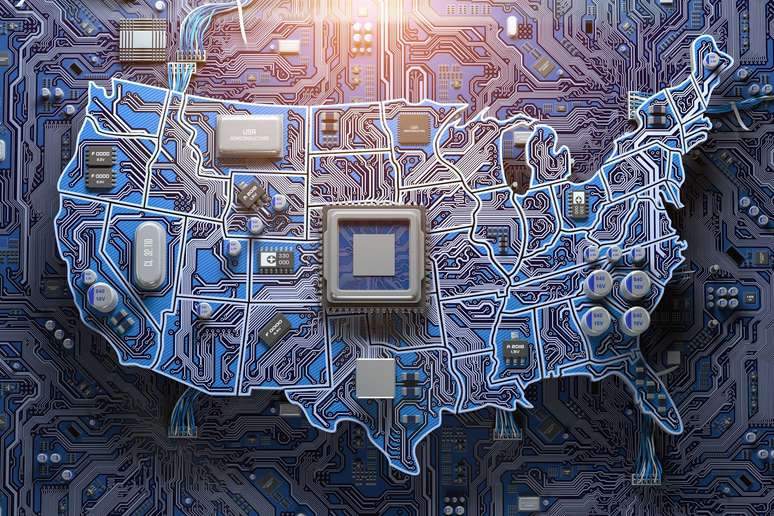

The United States are trying to create a chip industry through isolation and protectionism, while what allowed the rise of this sector to Asia was the opposite: the collaboration.

The United States “have dropped the Shuttlecock” in the production of chips over the years, allowing China and other Asian production centers to advance fully. This is what Gina Raimondo told me, then secretary of the United States Trade, in an interview in 2021.

Four years later, the chips remain a battlefield in the United States and China controversies on technological supremacy, and the president of the United States Donald Trump now wants to increase a highly complex and delicate production process that has required decades to be perfected in other regions.

He says that his tariff policy will free the United States economy and report jobs in the country, but it is also true that some of the largest companies have fought for a long time with the lack of qualified workers and low -quality products in their US factories.

What will Trump do different? And considering that Taiwan and other parts of Asia emerge in the production of high precision chips, will the United States also be able to produce them and on a large scale?

Microchip: the cat pulo do

Semiconductors are fundamental to provide everything, from iPhone washing machines, from military jets to electric vehicles. These high wafer The silicon, known as chips, has been invented in the United States, but it is currently in Asia that the most advanced chips are produced on a phenomenal scale.

Their production is expensive and technologically complex. An iPhone, for example, can contain US manufacturing chips, made in Taiwan, Japan or South Korea, using raw materials as rare earth metals, extracted mainly in China. So they can be sent to Vietnam for packaging, then in China for assembly and tests before being sent to the United States.

It is a deeply integrated ecosystem that has evolved over the decades.

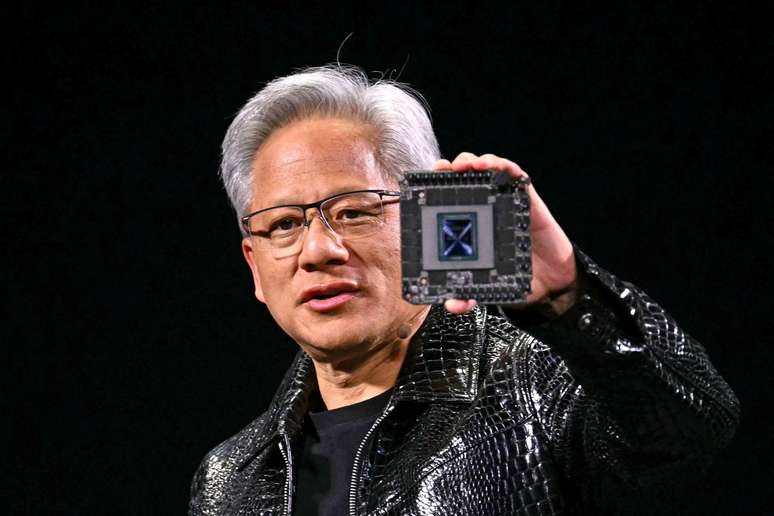

Trump praised the chip industry, but he also threatened it with rates. Taiwan Semiconductor Manufacturing Company (TSMC), who should have paid a 100% fee if he had not built factories in the United States, told the leading company.

With such a complex ecosystem and strong competition, companies must be able to plan higher long -term expenses and investments, well beyond the Trump government. Constant political changes are not helping. So far, some have shown the will to invest in the United States.

The significant subsidies that China, Taiwan, Japan and South Korea offer to private companies that develop chips are one of the main reasons for their success.

This was largely the thought at the basis of the law on US chips, sanctioned in 2022 during the government of the then president Joe Biden – an attempt to reposition the production of chips and diversify the supply chains allocating tax credits and subsidies to encourage national production.

Some companies, such as the largest chip manufacturer in the world, TSMC, and the largest smartphone manufacturer in the world, Samsung have become the main beneficiaries of the legislation: TSMC has received 6.6 billion dollars in reliefs and factories for factories in Arizona and Samsung has received about $ 6 billion for installation in Taylor, Texas.

TSMC has announced an additional investment of $ 100 billion in the United States with Trump, in addition to the 65 billion dollars promised for three factories. The diversification of chip production also works for TSMC, with China that repeatedly threatens to take control of Taiwan.

But both TSMC and Samsung have faced challenges with their investments, including greater costs, difficulties in recruiting qualified labor, delays in construction and resistance by local unions.

“This is not just a factory in which boxes are created,” says Marc Einstein, director of the research of the Counterpoint Market Intelligence Company. “The factories that produce chips are sterile high -tech environments and take years and years to build”.

And despite US investments, TSMC said that most of its production will remain in Taiwan, in particular by the most advanced computer chips.

Has China tried to steal the charge of Taiwan?

Tsmc factories in Arizona are currently producing high quality chips. But Chris Miller, author of the book The war of chips: the battle for the technology that moves the worldHe claims that “I am a generation behind the state of Taiwan, the -art technology”.

“The problem of the staircase depends on how many investments are made in the United States compared to Taiwan,” he adds. “Today Taiwan has much more ability.”

The reality is that Taiwan has used decades to develop this ability and, despite China’s threat to spend billions to steal Taiwan’s place in the sector, the country continues to thrive.

TSMC was the pioneer of the “casting model”, in which chip producers led to projects and chips manufactured to other companies.

Taking advantage of the wave of start-up From Silicon Valley, such as Apple, Qualcomm and Intel, TSMC has been able to compete with the American and Japanese giants with the best engineers, the highly qualified work and the sharing of knowledge.

“The United States could make chips and create jobs?” He asks Einstein. “Of course, but will they be able to do chips up to a nanometer? Probably not.”

One of the reasons is Trump’s immigration policy, which can potentially limit the arrival of qualified talents in China and India.

“Elon Musk also had an immigration problem with Tesla engineers,” says Einstein, referring to Musk’s support for the H-Visa USA program for qualified workers.

“This is a bottleneck and there is nothing that they can do if they do not totally change their position on immigration. You cannot simply create doctorals from nothing.”

The global domino effect

Even so, Trump has strengthened the bet on rates, ordering an investigation into national security on the semiconductor sector.

“It’s an obstacle – a great barrier,” says Einstein. “Japan, for example, was based on its economic revitalization in the semiconductors and the rates were not on the corporate plane”.

The long -term impact on the sector, according to Miller, will probably be a renewed attention to national production in many of the best economies in the world: China, Europe and the United States.

Some companies can look for new markets. The Chinese giant of Huawei technology, for example, has extended to Europe and emerging markets, including Thailand, United Arab Emirates, Saudi Arabia, Malaysia and various countries from Africa, facing export controls and rates, although margins in developing countries are small.

“In the end, China will want to win, must innovate and invest in research and development. See what she did with Deepseek,” says Einstein, referring to the chatbot of artificial intelligence created in China.

“If they build better chips, everyone will choose them. The cost is something they can offer now and, in the future, it is the production of very high technology.”

In the meantime, new production centers could arise. India is quite promising, according to experts who say that there are more chances to integrate the chip supply chain than the United States: the country is geographically closer, the work is cheap and the education is of quality.

India has reported that it is open to the production of chips, but has to face a series of challenges, including the acquisition of soils and water soils, the production of chips needs higher quality water in large quantities.

Open to negotiations

Chip companies are not completely at the mercy of rates. The enormous dependence and demand of chips on large American companies such as Microsoft, Apple and Cisco can press Trump to reverse any rate on the chip industry.

Some experts believe that Apple’s intense hall, Tim Cook, has ensured the exemption of smartphones, laptops and tariff electronics and that Trump suspended the ban related to the ban that Nvidia can sell in China following the hall.

When apple products specifically questioned Monday (14/4) at the Oval Hall, Trump said: “I am a very flexible person”, adding that “maybe there is news in advance, I speak with Tim Cook, I recently helped Tim Cook”.

Einstein believes that everything is reduced to the fact that Trump is trying to make an agreement: he and his government know that they cannot simply build a wider building when it comes to chips.

“I think what the Trump administration is trying to do both what he has done with Bytedance, owner of Tiktok. He is saying: I will no longer allow you to operate in the United States, unless you give an American company to have a participation in Oracle or another”, explains Einstein.

“I think they are trying to do something similar here-tsmc is not going anywhere, let’s force it to make an agreement with Intel and get a slice of cake.”

But the ecosystem project of Asian semiconductors offers a precious lesson: no country can manage a single sector of chips – and if you want to create advanced semiconductors efficiently and on a large scale, it will take time.

Trump is trying to create a chip industry through protectionism and isolation, while what allowed the rise of the chip industry throughout Asia was the opposite: the collaboration in a globalized economy.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.