The source of investment has dried up for new businesses in early 2023. The entrepreneur who wants to attract capital must be in the right area

The reduction of investments in startups is a widespread theme: in the first quarter of 2023 there was an 86% drop in capital invested in new domestic companies, compared to the same period in 2022, according to recent data from the Inside Venture Capital report. of Distrito. Yet, undeniably, there are sectors that are suffering more than others and are seeing resources dwindling at a faster rate.

Among these, the Supply Chain segment has the lowest movement in the period: there were only 2 deals closed in the period, as demonstrated by the same survey by Distrito, a platform that encourages entrepreneurial culture. In terms of volume loss, Mobility and Healthtech are other low-investment sectors.

At the high end, fintechs remain a priority in terms of receiving funding, but it is already possible to note other important highlights, such as HRTechs – companies specializing in the automation of HR processes -, which have had the best evolution in the period , as well as EdTech (Technology for Education) and Real Estate (Real Estate Market).

It’s the one above, salt

For Paulo Costa, CEO of Cubo Itaú, it had already been predicted that fintechs would continue to receive great attention from investors in lean times, thanks to the trend of consolidation of the new consumption habits of Brazilians involving new means of payment digital, such as Pix. “Moreover, most of the founders of the sector are already on their second or third venture, which is a decisive factor in increasing investor confidence given their maturity and history of experience,” he reiterates.

Healthtech, on the other hand, which experienced a sharp increase in investments during the pandemic, is now returning to its previous level, with an expected decline in volumes, continues the executive: “This demonstrates stability in the segment with the same potential for delivering efficiency to the market” .

“One way for Health Technicians to build momentum this year is to connect with other large companies, such as therapy platforms or physical businesses, providing more options for wellness and health. This can be the differential for customers and a highlight in the market,” said Paulo Costa.

I, entrepreneur

Speaking of a more mature investor profile, the same has been noted in the national entrepreneur, according to the Founders Overview report, produced by the venture capital holding company Ace Ventures, together with BHub and a55. The survey, which interviewed more than 200 entrepreneurs with an annual turnover between R$ 360,000 and R$ 300 million, concluded that more than half (51%) are setting up their second company and around 80% have partners in the own business.

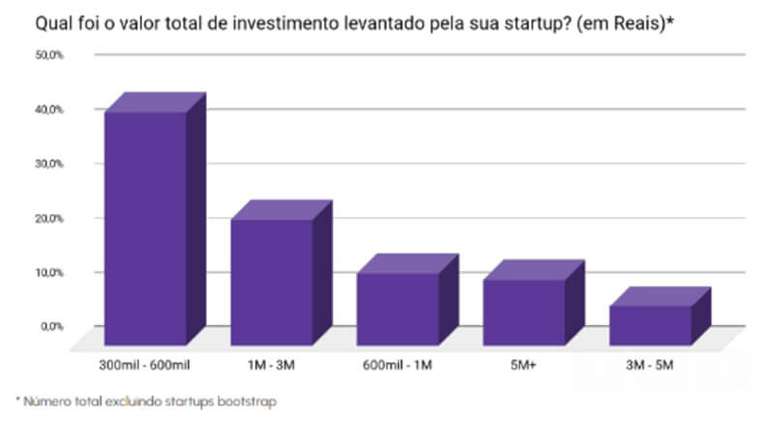

Although the priority contribution profile is still own financing, with almost half of entrepreneurs (44.6%) using own resources (bootstrap), 25% use Venture Capital as the main method, followed by angel investments (15.5 %) and Corporate Venture Capital (CVC), with 14%. Despite this, investors’ aversion to the current risk of investing in a startup can be seen, as shown in the chart below:

He, the investor

Pedro Waengertner, co-founder and CEO of ACE Ventures, clarifies that the current concern of investors is the survival of the asset in which the capital is invested: “It is not that there is no money to invest in new companies, but that the money have a different criterion for entering,” he sums up.

It’s just that the abundance of risky investments in recent years has led many people to the venture capital market with the idea that this type of operation is easy and with a guaranteed return, which is not true. And those who had previously ventured into this market have now pulled their team out of the field when they have noticed that it is a different type of investment from the so-called traditional financial market, since venture capital requires several rounds of contributions, often with difficulty – or takes time – return.

“One of the main concerns that today’s entrepreneur must have is: will my startup be able to capture the next investment rounds so that it can achieve the expected growth trajectory?”, says Pedro Waengertner.

Futures markets: unsexy appeal, great return

However, in the near future, some sectors are more promising for the venture capital investor, even if they are not as seductive in their ideas, so to speak. Pedro Waengertner mentions logistics solutions startups, whose sector requires innovation and there is room for many ideas to thrive. “Another novelty is AITech, artificial intelligence, where the American market is already contributing a lot of money,” he adds.

Paulo Costa recalls that the whole world is turning its attention to three acronyms: ESG. And, therefore, he believes that energy startups, cleantechs and climatetechs will have great space and great demand in the country.

Whichever industry you choose, one lesson remains important, like Rodrigo Guerra, founder of Unbox Project, recalls: “No startup needs to be a unicorn to thrive, it just needs to generate a good result to be successful. So, it is up to every investor to look at their idea and ask themselves: will I be satisfied with this business itself or with its sale? This response is what will shape future paths – whether or not to attract the right investments,” he concludes.

Renata Armas is the publisher ofunbox project

, a career development program that connects business leaders, self-organized entities and companies with ESG goals to unlock innovation and a sustainable economy. As part of its mission to “bust the critical thinking that should precede innovation”, it produces recurring content on the unbox.dev.br website and in the Homework section of the Terra portal.

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.