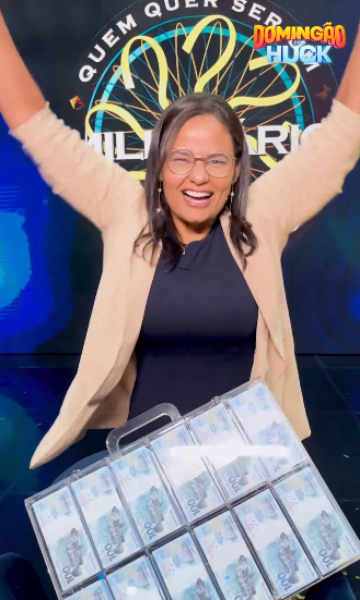

Jullie Dutra became the first person to win first prize at the Domingão show with Huck

The journalist Julie Dutrawho became the first person to win the board’s top prize Who Wants to Be a Millionaire, from Domingão com Huck, Do you already know what you will do with the sum of money? R$ 1 million.

In an interview on the program Meeting with Patricia Poeta, the woman from Pernambuco said she intends to invest the money in her studies. The country’s new millionaire wants to pursue a diplomatic career.

“I will invest in my studies. I entered that program with the goal of earning R$1 million. I always knew that I would leave with R$1 million. My goal was to earn that amount and invest in my career diplomatic,” he explained.

Who is Jullie Dutra, the first winner of the R$ 1 million prize in ‘Domingão com Huck’

OR Earth spoke earlier this week with experts to understand where, in addition to studies, it is possible to invest money and which scenarios, between the expected, the pessimistic and the optimistic, will bring the best results.

“When it comes to investments, the watchword is diversification, both for those who are starting out and for those who have R$ 1 million in their current account”, underlines Marcos Milan, professor at the FIA Business School. “The first step towards this diversification is the formation of an emergency reserve, which should correspond to approximately 6 months of the person or family’s expenses.”

For this reserve, the ideal is to invest in highly liquid and low-risk assets, such as the Treasury Selic. “The rest must be distributed based on the investor’s objectives and needs. From changing the car, to paying taxes at the beginning of the year up to retirement”, he adds.

Vitor Oliveira, wealth planning specialist at One Investimentos, also highlights the importance of analyzing the investor’s profile first. “There are people who can handle more risk and others who are a little more moderate or even extremely conservative, who stay in investments that yield less, but have less risk, so it makes more sense for them,” he reflects.

“In general, we really like to work with deadlines. Thinking about long- and medium-term scenarios, it’s very interesting to diversify your portfolio. So, you can have some CDI, you can have some direct treasury, you can also have inflation and therefore work with long-term diversification, which will always generate much greater returns than if you allocated all your resources into a single asset.”

Source: Terra

Rose James is a Gossipify movie and series reviewer known for her in-depth analysis and unique perspective on the latest releases. With a background in film studies, she provides engaging and informative reviews, and keeps readers up to date with industry trends and emerging talents.